Albertsons 2004 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In July and August 2002, several class action lawsuits were filed against the company and certain of its

officers and directors in the United States District Court for the District of Minnesota on behalf of purchasers of

the company’s securities between July 11, 1999 and June 26, 2002. The lawsuits have been consolidated into a

single action, in which it is alleged that the company and certain of its officers and directors violated Federal

securities laws by issuing materially false and misleading statements relating to its financial performance. On

April 29, 2004, the District Court for the District of Minnesota granted preliminary approval to a stipulation of

settlement between the company and plaintiffs. A hearing for final approval of the settlement is scheduled for

August 16, 2004. The settlement will have no material impact to the company’s consolidated statement of

earnings or consolidated financial position.

The company is a party to various legal proceedings arising from the normal course of business activities,

none of which, in management’s opinion, is expected to have a material adverse impact on the Company’s

consolidated statement of earnings or consolidated financial position.

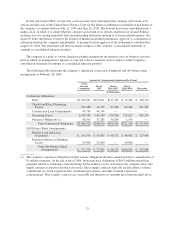

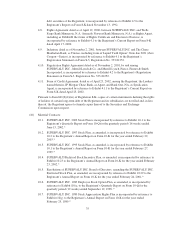

The following table represents the company’s significant contractual obligations and off-balance sheet

arrangements at February 28, 2004.

Amount of Commitment Expiration Per Period

Total

Amount

Committed

Fiscal

2005

Fiscal

2006-2007

Fiscal

2008-2009 Thereafter

(in thousands)

Contractual Obligations:

Debt $1,385,297 $273,811 $137,791 $ 16,956 $ 956,739

Capital and Direct Financing

Leases 554,368 32,133 87,680 82,986 351,569

Construction Loan Commitments 44,734 44,734 — — —

Operating Leases 1,032,563 160,589 239,026 229,822 403,126

Purchase Obligations (1) 68,963 37,383 30,204 1,376 —

Total Contractual Obligations $3,085,925 $548,650 $494,701 $331,140 $1,711,434

Off-Balance Sheet Arrangements:

Retailer Loan and Lease

Guarantees $ 290,359 $ 50,087 $ 68,132 $ 46,692 $ 125,448

Purchase Options on Synthetic

Leases 85,000 25,000 — 60,000 —

Total Off-Balance Sheet

Arrangements $ 375,359 $ 75,087 $ 68,132 $106,692 $ 125,448

(1) The company’s purchase obligations include various obligations that have annual purchase commitments of

$1 million or greater. At the end of fiscal 2004, future purchase obligations of $69.0 million existed that

primarily related to technology and advertising. In the ordinary course of business, the company enters into

supply contracts to purchase products for resale. These supply contracts typically include either a volume

commitment or a fixed expiration date; termination provisions; and other standard contractual

considerations. These supply contracts are cancelable and therefore no amounts have been included above.

25