Albertsons 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

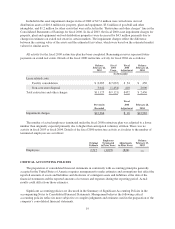

COMMON STOCK PRICE

SUPERVALU’s common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal

2004 year end, there were 6,839 shareholders of record compared with 6,960 at the end of fiscal 2003.

Common Stock Price Range Dividends Per Share

2004 2003 2004 2003

Fiscal High Low High Low

First Quarter $22.74 $12.60 $30.81 $24.60 $0.1425 $0.1400

Second Quarter 24.99 20.80 28.94 19.18 0.1450 0.1425

Third Quarter 26.29 23.39 21.59 14.75 0.1450 0.1425

Fourth Quarter 29.95 25.20 18.12 14.01 0.1450 0.1425

Year 29.95 12.60 30.81 14.01 0.5775 0.5675

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to

the Board of Directors approval.

NEW ACCOUNTING STANDARDS

In June 2001, the Financial Accounting Standards Board (FASB) issued SFAS No. 143, “Accounting for

Asset Retirement Obligations”, which addresses financial accounting and reporting for obligations associated

with the retirement of tangible long-lived assets and the associated asset retirement costs. The company adopted

the provisions of SFAS No. 143 in the first quarter of fiscal 2004. The adoption of SFAS No. 143 did not have an

impact on the company’s consolidated financial statements.

In April 2002, the FASB issued SFAS No. 145, “Rescission of FASB Statements No. 4, 44 and 64,

Amendment of FASB Statement No. 13, and Technical Corrections”. SFAS No. 145 allows only those gains and

losses on the extinguishment of debt that meet the criteria of extraordinary items to be treated as such in the

financial statements. SFAS No. 145 also requires sale-leaseback accounting for certain lease modifications that

have economic effects that are similar to sale-leaseback transactions. Certain provisions of SFAS No. 145 were

effective for transactions occurring after May 15, 2002, while the remaining provisions were effective for the

company in the second quarter of fiscal 2004. The adoption of SFAS No. 145 did not have an impact on the

company’s consolidated financial statements.

In April 2003, the FASB issued SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments

and Hedging Activities”. SFAS No. 149 amends and clarifies financial accounting and reporting for derivative

instruments, including certain derivative instruments imbedded in other contracts and for hedging activities under

SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities”. SFAS No. 149 was effective

for contracts entered into or modified after June 30, 2003 and for hedging relationships designated after June 30,

2003. The adoption of SFAS No. 149 did not have an impact on the company’s consolidated financial statements.

In May 2003, the FASB issued SFAS No. 150, “Accounting for Certain Financial Instruments with

Characteristics of Both Liabilities and Equity”. SFAS No. 150 establishes standards for how an issuer classifies

and measures certain financial instruments with characteristics of both liabilities and equity. SFAS No. 150 was

effective for financial instruments entered into or modified after May 31, 2003 and otherwise was effective at the

beginning of the first interim period beginning after June 15, 2003. The adoption of SFAS No. 150 did not have

an impact on the company’s consolidated financial statements.

In December 2003, the FASB issued revisions to SFAS No. 132, “Employers’ Disclosures about Pensions

and Other Postretirement Benefits”. These revisions require changes to existing disclosures as well as new

disclosures related to pension and other postretirement benefit plans. The revisions to SFAS No. 132, except for

those relating to expected future benefit payments, are effective for fiscal years ending after December 15, 2003

26