Albertsons 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

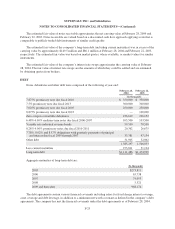

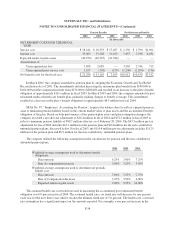

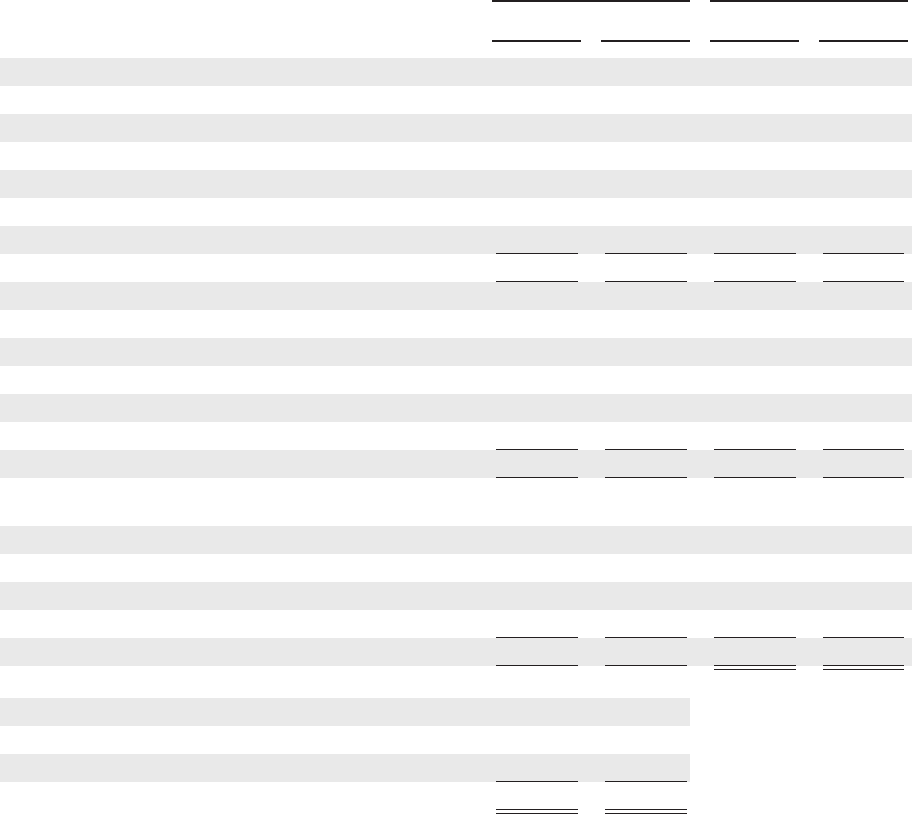

The following tables set forth the changes in benefit obligations and plan assets, a reconciliation of the

accrued benefit costs and total benefit costs for the fiscal years for the company’s non-union defined benefit

pension plans and the post retirement benefit plans:

Pension Benefits Post Retirement Benefits

February 28,

2004

February 22,

2003

February 28,

2004

February 22,

2003

(In thousands)

CHANGES IN BENEFIT OBLIGATIONS

Benefit obligations at beginning of year $ 502,383 $ 466,770 $ 111,320 $ 103,687

Service cost 18,243 18,333 1,350 1,790

Interest cost 35,003 33,228 7,457 7,336

Plan amendments — 10,123 (4,495) —

Actuarial (gain) loss 86,248 (5,709) 17,025 5,445

Benefits paid (23,307) (20,362) (7,576) (6,938)

Benefit obligations at end of year $ 618,570 $ 502,383 $ 125,081 $ 111,320

CHANGES IN PLAN ASSETS

Fair value of plan assets at beginning of year $ 393,104 $ 396,034 $ — $ —

Actual return on plan assets 72,012 (26,846) — —

Company contributions 25,000 44,278 7,576 6,938

Plan participants’ contributions — — 4,801 4,120

Benefits paid (23,307) (20,362) (12,377) (11,058)

Fair value of plan assets at end of year $ 466,809 $ 393,104 $ — $ —

RECONCILIATION OF PREPAID (ACCRUED) COST

AND TOTAL AMOUNT RECOGNIZED

Funded status $(151,761) $(109,279) $(125,081) $(111,320)

Accrued contribution ————

Unrecognized net loss 216,919 169,611 59,723 46,003

Unrecognized prior service cost 9,027 10,134 (10,033) (6,738)

Prepaid (accrued) cost $ 74,185 $ 70,466 $ (75,391) $ (72,055)

Prepaid benefit cost $ — $ —

Accrued benefit liability (90,439) (52,144)

Intangible asset 9,027 10,134

Accumulated other comprehensive income 155,597 112,476

Total recognized $ 74,185 $ 70,466

F-33