Albertsons 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

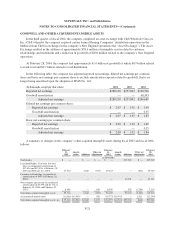

GOODWILL AND OTHER ACQUIRED INTANGIBLE ASSETS

In the third quarter of fiscal 2004, the company completed an asset exchange with C&S Wholesale Grocers,

Inc. (C&S) whereby the company acquired certain former Fleming Companies’ distribution operations in the

Midwest from C&S in exchange for the company’s New England operations (the “Asset Exchange”). The Asset

Exchange resulted in the addition of approximately $58.6 million of intangible assets related to customer

relationships and trademarks and a reduction in goodwill of $20.0 million related to the company’s New England

operations.

At February 28, 2004, the company had approximately $1.6 billion of goodwill of which $0.9 billion related

to retail food and $0.7 billion related to food distribution.

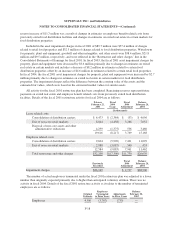

In the following table, the company has adjusted reported net earnings, diluted net earnings per common

share and basic net earnings per common share to exclude amortization expense related to goodwill, that is no

longer being amortized upon the adoption of SFAS No. 142:

(In thousands, except per share data) 2004 2003 2002

Reported net earnings $280,138 $257,042 $198,326

Goodwill amortization — — 48,363

Adjusted net earnings $280,138 $257,042 $246,689

Diluted net earnings per common share:

Reported net earnings $ 2.07 $ 1.91 $ 1.48

Goodwill amortization — — 0.35

Adjusted net earnings $ 2.07 $ 1.91 $ 1.83

Basic net earnings per common share:

Reported net earnings $ 2.09 $ 1.92 $ 1.49

Goodwill amortization — — 0.35

Adjusted net earnings $ 2.09 $ 1.92 $ 1.84

A summary of changes in the company’s other acquired intangible assets during fiscal 2003 and fiscal 2004

follows:

February

23,

2002

Amorti-

zation Additions

Other net

adjustments

February

22,

2003

Amorti-

zation Additions

Other net

adjustments

February

28,

2004

(in thousands)

Trademarks $ — $ — $ — $ — $15,269 $ — $15,269

Leasehold Rights, Customer lists and

other (accumulated amortization of

$17,836 and $15,396, at February 28,

2004 and February 22, 2003) 47,310 2,660 (307) 49,663 — (294) 49,369

Customer relationships (accumulated

amortization of $495 at February 28,

2004) — — — — 43,361 — 43,361

Non-compete agreements (accumulated

amortization of $3,959 and $4,376 at

February 28, 2004 and February 22,

2003) 8,406 — 100 8,506 502 (1,789) 7,219

Total other acquired intangible assets 55,716 2,660 (207) 58,169 59,132 (2,083) 115,218

Accumulated amortization (16,298) $(3,903) — 429 (19,772) $(4,541) — 2,023 (22,290)

Total other acquired intangible assets, net $ 39,418 $(3,903) $2,660 $ 222 $ 38,397 $(4,541) $59,132 $(60) $92,928

F-21