Albertsons 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

coupons should reflect the value of the coupon as revenue and not as a reduction in cost of sales. EITF Issue No.

03-10 was effective for the first interim period beginning after November 25, 2003. The adoption of EITF Issue

No. 03-10 did not have an impact on the company’s consolidated financial statements.

In November 2002, the FASB issued FASB Interpretation No. (FIN) 45, “Guarantor’s Accounting and

Disclosures Requirements for Guarantees, Including Indirect Guarantees of Indebtedness of Others”. FIN 45

requires that upon issuance of a guarantee, a guarantor must recognize a liability for the fair value of an

obligation assumed under a guarantee. FIN 45 also requires statements about the obligations associated with

guarantees issued. The recognition provisions of FIN 45 were effective for guarantees issued after December 31,

2002, while the disclosure requirements were effective for financial statements for periods ending after

December 15, 2002. The adoption of FIN 45 did not have a material effect on the company’s consolidated

financial statements.

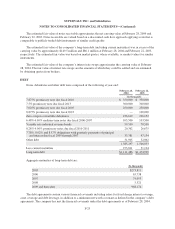

In December 2003, the FASB issued FIN 46 (revised December 2003), “Consolidation of Variable Interest

Entities” (FIN 46R), which addresses how a business should evaluate whether it has a controlling financial

interest in an entity through means other than voting rights and accordingly should consolidate the entity. FIN

46R replaced FIN 46 which was issued in January 2003. FIN 46 or FIN 46R applied immediately to entities

created after January 31, 2003 and no later than the end of the first reporting period that ended after December

15, 2003 to entities considered to be special-purpose entities (SPEs). FIN 46R is effective for all other entities no

later than the end of the first interim or annual reporting period ending after March 15, 2004. The adoption of the

provisions of FIN 46 or FIN 46R relative to SPEs and for entities created after January 31, 2003 did not have an

impact on the company’s consolidated financial statements. Additionally, the company does not expect the other

provisions of FIN 46R to have an impact on the its consolidated financial statements.

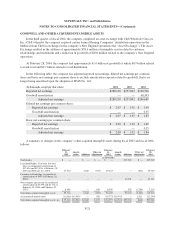

RESTRUCTURE AND OTHER CHARGES

For fiscal 2004, the company recognized pre-tax restructure and other charges of $15.5 million. The charges

reflect the net adjustments to the restructure reserves and asset impairment charges of $0.6 million, $14.4 million

and $0.5 million for restructure 2002, 2001 and 2000, respectively. The increases are due to continued softening

of real estate in certain markets and higher than anticipated employee benefit related costs.

The information within this note includes only those restructure and other charges that are the result of

previously initiated restructure activities. In addition, the company maintains reserves and has recorded certain

impairments for properties that have been closed as part of management’s ongoing operating decisions. Those

reserves and impairment charges are disclosed within the Reserves for Closed Properties and Asset Impairment

note in the Notes to Consolidated Financial Statements.

Restructure 2002

In fiscal 2002, the company identified additional efforts that would allow it to extend its food distribution

efficiency program that began early in fiscal 2001. The additional food distribution efficiency initiatives

identified resulted in pre-tax restructure charges of $16.3 million, primarily related to personnel reductions in

administrative and transportation functions. Management began the initiatives in fiscal 2003 and the majority of

these actions were completed by the end of fiscal 2003.

In fiscal 2003, the fiscal 2002 restructure charges were decreased by $3.6 million, including a decrease of

$1.4 million due to lower than anticipated lease related costs in transportation efficiency initiatives and a

decrease of $2.2 million in employee related costs due to lower than anticipated severance costs.

F-16