Albertsons 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUPERVALU INC. and Subsidiaries

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

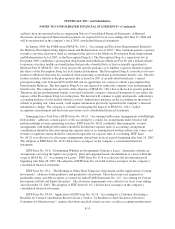

Reserves for Closed Properties and Asset Impairment Charges

The company maintains reserves for estimated losses on retail stores, distribution warehouses and other

properties that are no longer being utilized in current operations. The company provides for closed property lease

liabilities using a discount rate to calculate the present value of the remaining noncancellable lease payments

after the closing date, net of estimated subtenant income. The closed property lease liabilities usually are paid

over the remaining lease terms, which generally range from one to 20 years. The company estimates subtenant

income and future cash flows based on the company’s experience and knowledge of the market in which the

closed property is located, the company’s previous efforts to dispose of similar assets and current economic

conditions.

Owned properties that are closed are reduced to their estimated net realizable value. Costs to reduce the

carrying values of property, equipment and leasehold improvements are accounted for in accordance with the

company’s policy on impairment of long-lived assets. Impairment charges on long-lived assets are recognized

when expected net future cash flows are less than the assets’ carrying value. The company estimates net future

cash flows based on its experience and knowledge of the market in which the closed property is located and,

when necessary, utilizes local real estate brokers.

Adjustments to closed property reserves primarily relate to changes in subtenant income or actual exit costs

differing from original estimates. Adjustments are made for changes in estimates in the period in which the

changes become known. Closed property reserves are reviewed quarterly to ensure that any accrued amount that

is not a sufficient estimate of future costs, or that no longer is needed for its originally intended purpose, is

adjusted to income in the proper period.

The expectations on timing of disposition or sublease and the estimated sales price or sublease income

associated with closed properties are impacted by variable factors such as inflation, the general health of the

economy, resultant demand for commercial property, the ability to secure subleases, the creditworthiness of

sublessees and the company’s success at negotiating early termination agreements with lessors. While

management believes the current estimates on closed properties are adequate, it is possible that continued

weakness in the real estate market could cause changes in the company’s assumptions and may require additional

reserves and asset impairment charges to be recorded.

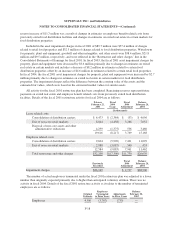

LIFO and Retail Inventory Method:

Inventories are stated at the lower of cost or market. Market is replacement value.

For a significant portion of the company’s inventory, cost is determined through use of the last-in, first-out

(LIFO) method. The company utilized LIFO to value approximately 68 percent and 71 percent of the company’s

consolidated inventories for fiscal 2004 and 2003, respectively. The first-in, first-out method (FIFO) is used to

determine cost for some of the remaining highly consumable inventories. If the FIFO method had been used to

determine cost of inventories for which the LIFO method is used, the company’s inventories would have been

higher by approximately $135.8 million at February 28, 2004 and $145.5 million at February 22, 2003.

The retail inventory method (RIM) is used to value retail inventory. The valuation of inventories are at cost

and the resulting gross margins are calculated by applying a calculated cost-to-retail ratio to the retail value of

inventories. RIM is an averaging method that has been widely used in the retail industry due to its practicality.

Reserves for Self Insurance:

The company is primarily self-insured for workers’ compensation and general and automobile liability

costs. It is the company’s policy to record its self insurance liabilities based on claims filed and an estimate of

claims incurred but not yet reported, discounted at a risk free interest rate. Any projection of losses concerning

F-11