Virgin Media 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

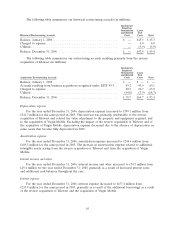

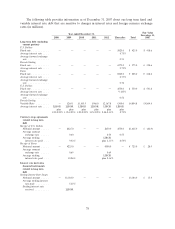

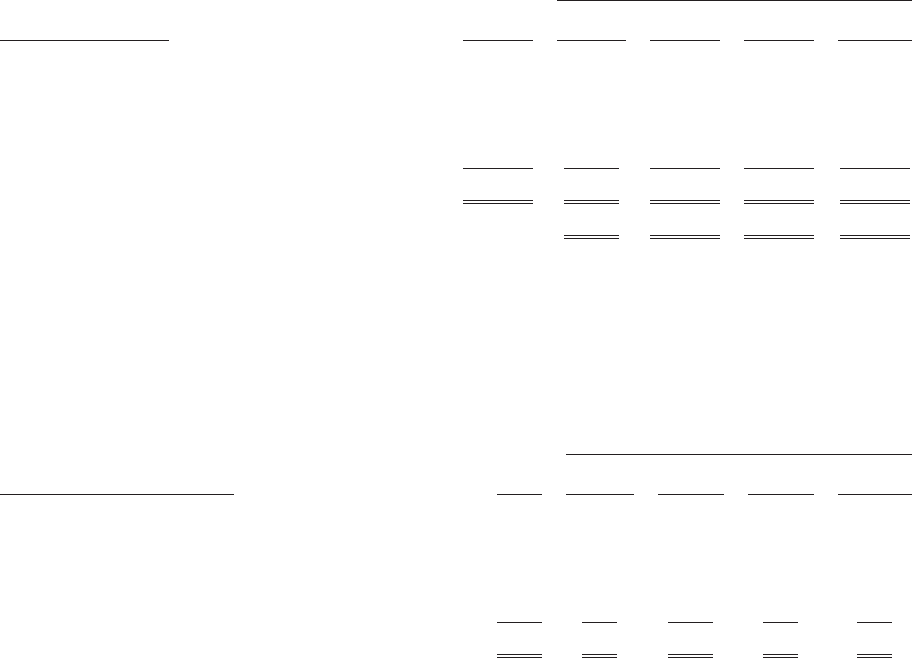

Contractual Obligations and Commercial Commitments

The following table includes aggregate information about our contractual obligations as of

December 31, 2007, and the periods in which payments are due (in millions).

Payments Due by Period

Less than More than

Contractual Obligations Total 1 year 1–3 years 3–5 years 5 years

Long Term Debt Obligations ............... £5,841.6 £ 1.8 £1,373.1 £3,134.2 £1,332.5

Capital Lease Obligations .................. 201.2 34.7 38.1 40.1 88.3

Operating Lease Obligations ................ 365.3 62.4 76.7 70.0 156.2

Purchase Obligations ..................... 724.1 354.2 202.4 117.7 49.8

Interest Obligations ...................... 1,982.0 459.3 824.3 517.2 181.2

Total ................................. £9,114.2 £912.4 £2,514.6 £3,879.2 £1,808.0

Early termination charges .................. £ 47.1 £ 71.9 £ 30.3 £ 4.9

Early termination charges are amounts that would be payable in the above periods in the event of

early termination during that period of certain of the contracts underlying the purchase obligations

listed above.

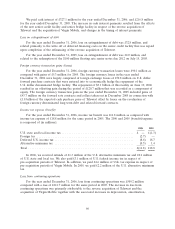

The following table includes information about our commercial commitments as of December 31,

2007. Commercial commitments are items that we could be obligated to pay in the future. They are not

required to be included in the consolidated balance sheet (in millions).

Amount of Commitment Expiration per Period

Less than More than

Other Commercial Commitments Total 1 year 1–3 years 3–5 years 5 years

Guarantees ............................... £10.0 £1.7 £ — £ — £8.3

Lines of Credit ............................ — — — — —

Standby Letters of Credit ..................... 21.4 4.7 15.3 — 1.4

Standby Repurchase Obligations ................ — — — — —

Other Commercial Commitments ............... — — — — —

Total Commercial Commitments ................ £31.4 £6.4 £15.3 £ — £9.7

Guarantees relate to performance bonds provided by banks on our behalf as part of our

contractual obligations. The fair value of the guarantees has been calculated by reference to the

monetary value of each bond.

Derivative Instruments and Hedging Activities

We have a number of derivative instruments with a number of counterparties to manage our

exposures to changes in interest rates and foreign currency exchange rates. We account for these

instruments as hedges under FASB Statement No. 133, Accounting for Derivative Instruments and

Hedging Activities, or FAS 133, when the appropriate eligibility criteria has been satisfied, and to the

extent that they are effective. Ineffectiveness in our hedges, and instruments that we have not elected

for hedge accounting, are recognized through the statement of operations through gains or losses on

derivative instruments. The derivative instruments consist of interest rate swaps, cross-currency interest

rate swaps and foreign currency forward contracts.

We are subject to interest rate risk because we have substantial indebtedness at variable interest

rates. As of December 31, 2007, interest is determined on a variable basis on £4.8 billion, or 81%, of

75