Virgin Media 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. Significant Accounting Policies (Continued)

Software Development Costs

We capitalize costs related to computer software developed or obtained for internal use in

accordance with SOP 98-1, Accounting for the Costs of Computer Software Developed or Obtained for

Internal Use. Software obtained for internal use has generally been enterprise-level business and finance

software that we customize to meet our specific operational needs. Costs incurred in the application

development phase are capitalized and amortized over their useful lives, which are generally three to

five years. We have not sold, leased or licensed software developed for internal use to our customers

and we have no intention of doing so in the future.

Income Taxes

We provide for income taxes in accordance with FASB Statement No. 109, Accounting for Income

Taxes. Judgment is required in determining our provision for income taxes, deferred tax assets and

liabilities and the extent to which deferred tax assets can be recognized. We recognize deferred tax

assets only if it is more likely than not that sufficient taxable income will be available in the future

against which the temporary differences and unused tax losses can be utilized. We have considered

future taxable income and tax planning strategies in assessing whether deferred tax assets should be

recognized.

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income

Taxes—an interpretation of FASB Statement 109, or FIN 48. FIN 48 prescribes a comprehensive model

for recognizing, measuring, presenting and disclosing in the financial statements tax positions taken or

expected to be taken on a tax return, including a decision whether to file or not to file in a particular

jurisdiction. We adopted FIN 48 on January 1, 2007. The adoption did not have a material effect on

our consolidated financial statements.

Loss from Continuing Operations Per Share and Net (Loss) Income Per Share

Basic and diluted loss from continuing operations per share and net (loss) income per share are

computed by dividing the loss from continuing operations and net (loss) income, respectively, by the

average number of shares outstanding during the years ended December 31, 2007, 2006 and 2005.

Options, warrants and shares of restricted stock held in escrow are excluded from the calculation of

diluted net loss from continuing operations per share for all periods presented since the inclusion of

such options, warrants and shares of restricted stock is anti-dilutive. The average number of shares

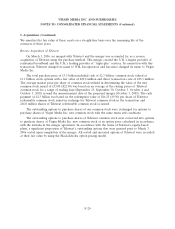

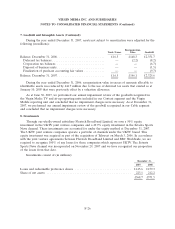

outstanding is computed as follows (in millions) (as adjusted for the reverse acquisition of Telewest):

Year ended December 31,

2007 2006 2005

Adjusted number of shares outstanding at start of period ................. 323.9 212.9 219.0

Issues of common stock (average number outstanding during the period) ..... 2.0 80.0 1.3

Repurchase of stock ............................................ — — (6.5)

Average number of shares outstanding .............................. 325.9 292.9 213.8

F-17