Virgin Media 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

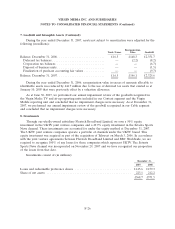

12. Stock-Based Compensation Plans (Continued)

established. That cost is expected to be recognized over a weighted-average period of 1.1 years. In

addition, the non-vested shares in the table above include 583,334 shares for which the measurement

date criteria under FAS 123R have not yet been established and consequently no compensation cost has

been determined.

The total fair value of shares vested during the years ended December 31, 2007, 2006 and 2005,

was £7.9 million, £1.3 million, and £1.0 million, respectively.

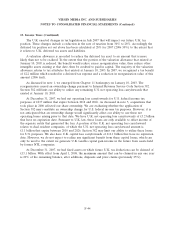

Virgin Media Long Term Incentive Plan

Participants in the Virgin Media Long Term Incentive Plan for 2007, 2006 and 2005 are awarded

restricted stock units which vest after a three year period dependent on the achievement of certain long

term performance targets and continued employment. The final number of restricted stock units vested

will be settled, at our discretion, in either common stock or an amount of cash equivalent to the fair

market value at the date of vesting.

The total number of restricted stock units awarded under the 2007, 2006 and 2005 Long Term

Incentive Plans was 1,330,456, 1,143,472 and 440,563, respectively, of which nil, 65,416 and 274,784 had

lapsed due to the cessation of employment as at December 31, 2006, and 174,676, 386,876 and 332,733

had lapsed due to the cessation of employment as at December 31, 2007.

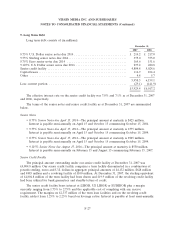

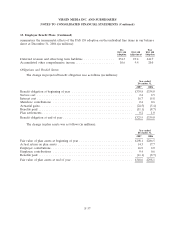

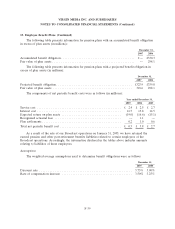

13. Employee Benefit Plans

Defined Benefit Plans

Certain of our subsidiaries operate defined benefit pension plans in the U.K. The assets of the

plans are held separately from those of ourselves and are invested in specialized portfolios under the

management of investment groups. The pension cost is calculated using the projected unit method. Our

policy is to fund amounts to the defined benefit plans necessary to comply with the funding

requirements as prescribed by the laws and regulations in the U.K. Our defined benefit pension plans

use a measurement date of December 31.

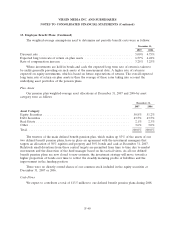

Employer Contributions

In April 2007, we agreed with the trustees of one of our pension plans to a new funding

arrangement whereby we will initially be paying £8.6 million per annum towards the deficit for the next

three years. Additionally, in June 2007, we effected a merger of our three other defined benefit plans.

The merger of these plans was subject to the approval of the trustees and, as a condition of trustee

approval, we agreed to make a specific one-time contribution of £4.5 million. The funding

arrangements with respect to this plan included an agreement to pay a further £2.6 million to fund the

deficit for the next seven years. For the year ended December 31, 2007, we contributed £17.3 million to

our pension plans. We anticipate contributing a total of £13.5 million to fund our pension plans in

2008.

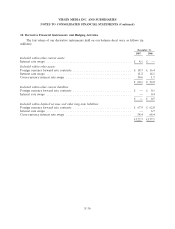

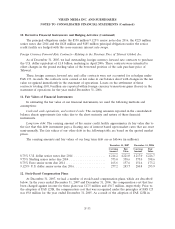

We adopted the provisions of Statement of Financial Accounting Standards No. 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB

Statements No. 87, 88, 106, and 132(R), or FAS 158, as of December 31, 2006. The table below

F-36