Virgin Media 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. Income Taxes (Continued)

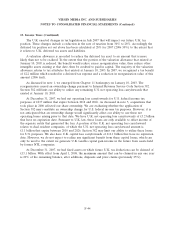

The U.K. enacted changes in tax legislation in July 2007 that will impact our future U.K. tax

position. These changes include a reduction in the rate of taxation from 30% to 28%. Accordingly the

deferred tax position set out above has been calculated at 28% for 2007 (2006 30%) to the extent that

it relates to U.K. deferred tax assets and liabilities.

A valuation allowance is recorded to reduce the deferred tax asset to an amount that is more

likely than not to be realized. To the extent that the portion of the valuation allowance that existed at

January 10, 2003 is reduced, the benefit would reduce excess reorganization value, then reduce other

intangible assets existing at that date, then be credited to paid in capital. The majority of the valuation

allowance relates to tax attributes that existed at January 10, 2003. In 2007, we recognized a tax benefit

of £2.2 million which resulted in a deferred tax expense and a reduction in reorganization value of this

amount (2006 £nil).

As discussed in note 1, we emerged from Chapter 11 bankruptcy on January 10, 2003. The

reorganization caused an ownership change pursuant to Internal Revenue Service Code Section 382.

Section 382 will limit our ability to utilize any remaining U.S. net operating loss carryforwards that

existed at January 10, 2003.

At December 31, 2007, we had net operating loss carryforwards for U.S. federal income tax

purposes of £237 million that expire between 2018 and 2026. As discussed in note 5, acquisitions that

took place in 2006 affected our share ownership. We are evaluating whether the application of

Section 382 may constitute an ownership change for U.S. federal income tax purposes. However, it is

not anticipated that an ownership change would significantly affect our ability to use these net

operating losses arising prior to that date. We have U.K. net operating loss carryforwards of £3.2 billion

that have no expiration date. Pursuant to U.K. law, these losses are only available to offset income of

the separate entity that generated the loss. A portion of the U.K. net operating loss carryforward

relates to dual resident companies, of which the U.S. net operating loss carryforward amount is

£1.1 billion that expire between 2010 and 2026. Section 382 may limit our ability to utilize these losses

for U.S. purposes. We also have U.K. capital loss carryforwards of £12.1 billion that have no expiration

date. However, we do not expect to realize any significant benefit from these capital losses, which can

only be used to the extent we generate U.K. taxable capital gain income in the future from assets held

by former NTL companies.

At December 31, 2007, we had fixed assets on which future U.K. tax deductions can be claimed of

£13.1 billion. With effect from April 1, 2008, the maximum amount that can be claimed in any one year

is 20% of the remaining balance, after additions, disposals and prior claims (previously 25%).

F-44