Virgin Media 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

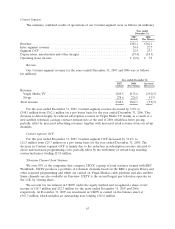

steps to increase alignment of the prices paid by our existing customers with the prices paid by new

customers. Partially offsetting these decreases have been increases in revenue from selective telephony

price increases as well as from additional customers subscribing to our television and broadband

services.

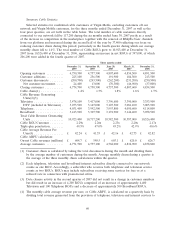

Cable ARPU decreased to £42.24 for the three months ended December 31, 2007 from £42.82 for

the three months ended December 31, 2006. The decrease in Cable ARPU was due to reduced

telephony usage and higher price discounting as discussed above. The decline has been mitigated by

our focus on acquiring new bundled customers and cross-selling and up-selling to existing customers.

Our focus on acquiring new bundled customers and on cross-selling to existing customers is shown by

Cable Revenue Generating Units, or Cable RGUs, per customer increasing to 2.29 at December 31,

2007 from 2.17 at December 31, 2006 and by ‘‘triple-play’’ penetration growing to 49.5% at

December 31, 2007 from 40.6% at December 31, 2006. A triple-play customer is a customer who

subscribes to our television, broadband and fixed line telephone services.

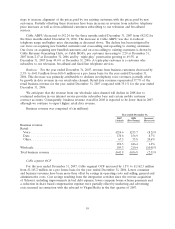

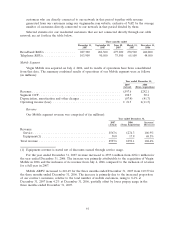

Business: For the year ended December 31, 2007, revenue from business customers decreased by

2.3% to £641.8 million from £656.8 million on a pro forma basis for the year ended December 31,

2006. This decrease was primarily attributable to declines in telephony voice revenues, partially offset

by growth in data revenue in our retail sales channel. Retail data revenues represented 37.7% of the

retail business revenue for the year ended December 31, 2007 compared with 35.1% for the year ended

December 31, 2006.

We anticipate that the revenue from our wholesale sales channel will decline in 2008 due to

continued reduction in our internet service provider subscriber base and certain mobile customer

contract accounts. Consequently, business revenue overall in 2008 is expected to be lower than in 2007,

although we continue to expect higher retail data revenue.

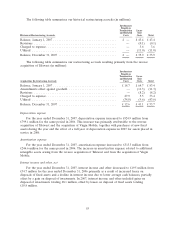

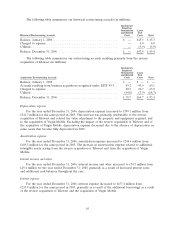

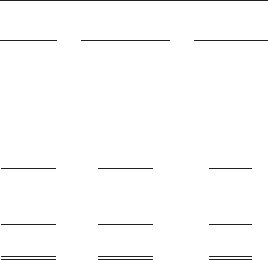

Business revenue was comprised of (in millions):

Year ended December 31,

2007 2006 Increase/

(Actual) (Pro Forma) (Decrease)

Business revenue:

Retail:

Voice .............................................. £214.6 £233.7 (8.2)%

Data .............................................. 170.6 156.9 8.7%

Other .............................................. 67.3 55.8 20.6%

452.5 446.4 1.4%

Wholesale ............................................ 189.3 210.4 (10.0)%

Total business revenue ................................... £641.8 £656.8 (2.3)%

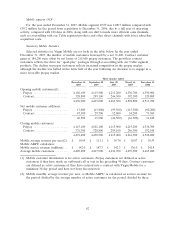

Cable segment OCF

For the year ended December 31, 2007, Cable segment OCF increased by 1.5% to £1,162.3 million

from £1,145.2 million on a pro forma basis for the year ended December 31, 2006. Lower consumer

and business revenues have been more than offset by savings in operating costs and selling, general and

administrative costs. Cost savings resulting from the integration activities since the reverse acquisition

of Telewest, including improvements in bad debt expense, lower company bonus scheme payments and

a reduction in share based compensation expense were partially offset by marketing and advertising

costs incurred in connection with the rebrand to Virgin Media in the first quarter of 2007.

59