Virgin Media 2007 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. Employee Benefit Plans (Continued)

Assumptions

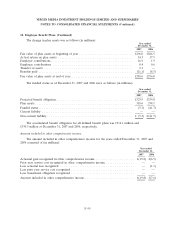

The weighted-average assumptions used to determine benefit obligations were as follows:

December 31,

2007 2006

Discount rate ..................................................... 5.75% 5.00%

Rate of compensation increase ........................................ 3.50% 3.25%

The weighted-average assumptions used to determine net periodic benefit costs were as follows:

December 31,

2007 2006

Discount rate ..................................................... 5.00% 4.75%

Expected long term rate of return on plan assets ........................... 6.57% 6.28%

Rate of compensation increase ........................................ 3.25% 3.25%

Where investments are held in bonds and cash, the expected long term rate of return is taken to

be yields generally prevailing on such assets at the measurement date. The higher rate of return is

expected on equity investments, which is based on future expectations of returns. The overall expected

long term rate of return on plan assets is then the average of these rates taking into account the

underlying asset portfolios of the pension plans.

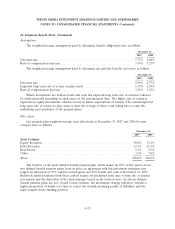

Plan Assets

Our pension plan weighted-average asset allocations at December 31, 2007 and 2006 by asset

category were as follows:

December 31,

2007 2006

Asset Category

Equity Securities ................................................. 50.8% 51.2%

Debt Securities .................................................. 43.5% 43.5%

Real Estate ..................................................... 2.1% 2.3%

Other ......................................................... 3.6% 3.0%

Total .......................................................... 100.0% 100.0%

The trustees of the main defined benefit pension plan, which makes up 83% of the assets of our

two defined benefit pension plans, have in place an agreement with the investment managers that

targets an allocation of 50% equities and property and 50% bonds and cash at December 31, 2007.

Relatively small deviations from these central targets are permitted from time to time due to market

movements and the discretion of the fund manager based on his tactical views. As all our defined

benefit pension plans are now closed to new entrants, the investment strategy will move towards a

higher proportion of bonds over time to reflect the steadily maturing profile of liabilities and the

improvement in the funding position.

F-97