Virgin Media 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

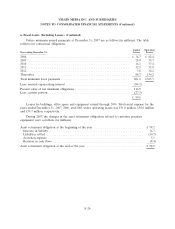

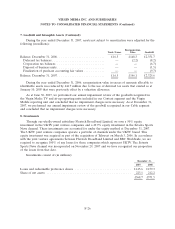

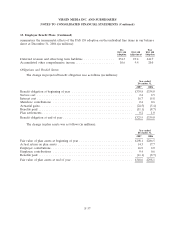

9. Long Term Debt (Continued)

On July 15, 2005, we redeemed the entire $100 million principal amount of the floating rate senior

notes due 2012 at a redemption price of 103% of the principal amount.

On February 4, 2005, we voluntarily prepaid £500 million of principal outstanding under our prior

senior credit facility using the proceeds from the sale of our Broadcast operations. On June 14, 2005

and July 14, 2005, we repaid a further £200 million and £23 million, respectively, using the proceeds

from the sale of our Ireland operations. On February 13, 2006, we voluntarily prepaid £100 million of

principal outstanding.

On March 3, 2006, the full outstanding balance of £1,358.1 million was repaid in respect of our

prior senior credit facility, £1,686.9 million was repaid in respect of Telewest’s then existing senior

credit facilities and £102.0 million was repaid in respect of Virgin Media TV’s then existing senior

credit facility. Our then existing facility and Telewest’s then existing facility were repaid in full utilizing

borrowings under the new senior credit facility. The Virgin Media TV facility was repaid from cash on

hand.

On September 27, 2006, we made a voluntary prepayment of £120.0 million of our senior credit

facility utilizing available cash reserves.

On April 13, 2007, we borrowed £890 million under our senior credit facility which is repayable in

2012, and used £863 million of the net proceeds to repay some of our obligations under our senior

credit facility that were originally scheduled to be paid from 2007 to 2011. In April 2007, we also

amended our senior credit facility agreement to allow for this £890 million of additional indebtedness,

the relaxation of certain financial covenants and additional flexibility to pay increased levels of

dividends on our common stock.

On May 15, 2007, we made a mandatory prepayment of £73.6 million on our senior credit facility

as a result of cash flow generated in 2006. On December 17, 2007, we made a voluntary prepayment of

£200 million utilizing available cash reserves.

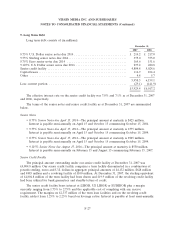

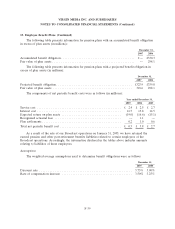

Senior Bridge Facilities

On March 3, 2006, one of our subsidiaries, Neptune Bridge Borrower LLC, drew in full from a

£1.8 billion bridge facility the U.S. dollar equivalent of $3,146.4 million and the proceeds were used in

connection with the reverse acquisition of Telewest. On June 19, 2006, the £1.8 billion bridge facility

was repaid in full utilizing drawings on the senior credit facility totaling £1.2 billion and an alternative

senior bridge facility of $1,048.8 million. The alternative senior bridge facility was repaid in two stages

utilizing the proceeds from the $550 million 9.125% senior notes due 2016 on July 25, 2006, and an

additional drawing from the senior credit facility on August 1, 2006. Debt issuance costs relating to the

bridge facility totaling £13.1 million were expensed during the year ended December 31, 2006.

F-29