Virgin Media 2007 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

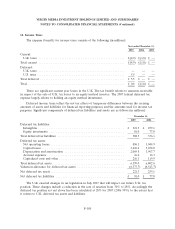

14. Income Taxes (Continued)

A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows

(in millions):

Balance at January 1, 2007 ............................................... £ 3.3

Additions based on tax positions related to the current year ...................... —

Additions for tax provisions of prior years ................................... —

Reductions for tax provisions of prior years ................................. (2.2)

Reductions for lapse of applicable statute of limitation ......................... —

Settlements ......................................................... —

Balance at December 31, 2007 ............................................. £ 1.1

The total amount of unrecognized tax benefits as of December 31, 2007 and January 1, 2007 was

£1.1 million and £3.3 million, respectively. If subsequently recognized, these would not impact the

effective tax rate, but would reduce goodwill. During 2007, we recognized £2.2 million of previously

unrecognized tax benefits due to a change in facts and circumstances. This had no impact on the

effective tax rate, as it affected goodwill. We do not expect that the amount of unrecognized tax

benefits will significantly increase or decrease in the next twelve months.

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. We

accrued interest in respect of unrecognized tax benefits of £0.1 million and £0.1 million at

December 31, 2007 and January 1, 2007, respectively. There was no interest benefit included in income

tax expense for the year ended December 31, 2007.

The statute of limitations is open for the years 2004 to 2007 in the U.S. and 2004 to 2007 in the

U.K., our major tax jurisdictions.

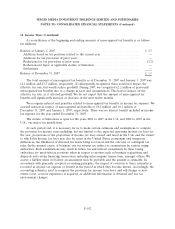

At each period end, it is necessary for us to make certain estimates and assumptions to compute

the provision for income taxes including, but not limited to the expected operating income (or loss) for

the year, projections of the proportion of income (or loss) earned and taxed in the U.K. and the extent

to which this income (or loss) may also be taxed in the United States, permanent and temporary

differences, the likelihood of deferred tax assets being recovered and the outcome of contingent tax

risks. In the normal course of business, our tax returns are subject to examination by various taxing

authorities. Such examinations may result in future tax and interest assessments by these taxing

authorities for uncertain tax positions taken in respect to matters such as business acquisitions and

disposals and certain financing transactions including intercompany transactions, amongst others. We

accrue a liability when we believe an assessment may be probable and the amount is estimable. In

accordance with generally accepted accounting principles, the impact of revisions to these estimates is

recorded as income tax expense or benefit in the period in which they become known. Accordingly, the

accounting estimates used to compute the provision for income taxes have and will change as new

events occur, as more experience is acquired, as additional information is obtained and our tax

environment changes.

F-102