Virgin Media 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

12. Stock-Based Compensation Plans (Continued)

2006, we recorded a cumulative effect of a change in accounting principle of £1.2 million to reduce

compensation expense recognized in previous periods.

The Virgin Media Inc. Stock Incentive Plan is intended to encourage Virgin Media stock

ownership by employees, directors and independent contractors so that they may acquire or increase

their proprietary interest in our company, and to encourage such employees, directors and independent

contractors to remain in our employ or service and to put forth maximum efforts for the success of the

business. To accomplish such purposes, the plan provides that we may grant incentive stock options,

nonqualified stock options, restricted stock, restricted stock units and share awards.

Under the Virgin Media Inc. Stock Incentive Plan, options to purchase up to 29.0 million shares of

our common stock may be granted from time to time to certain of our employees and our subsidiaries.

Accordingly, we have reserved 29.0 million shares of common stock for issuance under the Virgin

Media Inc. Stock Incentive Plan.

Stock Option Grants

As a result of the reverse acquisition of Telewest as described in note 5, the outstanding options on

March 3, 2006 were converted into 2.5 options to purchase shares in the new parent company, with a

corresponding reduction in exercise price. Along with this, each outstanding option issued by Telewest

prior to the acquisition was converted into 0.89475 options to purchase shares in the new parent

company, with a corresponding adjustment in the exercise price in accordance with the terms of the

merger agreement.

All options have a 10 year term and vest and become fully exercisable within five years of

continued employment. We issue new shares upon exercise of the options. The fair value for these

options was estimated at the date of grant using a Black-Scholes option-pricing model with the

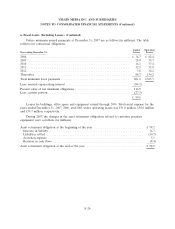

following weighted-average assumptions for the years ended December 31, 2007, 2006 and 2005:

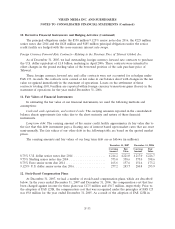

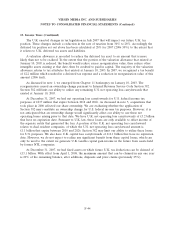

Year ended December 31,

2007 2006 2005

Risk-free Interest Rate ............................... 4.52% 4.79% 4.25%

Expected Dividend Yield .............................. 0.94% 0.00% 0.00%

Expected Volatility .................................. 29.04% 25.06% 37.50%

Expected Lives ..................................... 4.6 Years 2.4 Years 4.6 Years

The above weighted average assumptions for the year ended December 31, 2006 include options

converted on the merger with Telewest. Had these been excluded, the assumptions would have been as

follows; risk free interest rate 4.83%, expected dividend yield 0.00%, expected volatility 26.24% and

expected lives 4.3 years.

F-34