Virgin Media 2007 Annual Report Download - page 56

Download and view the complete annual report

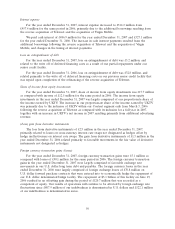

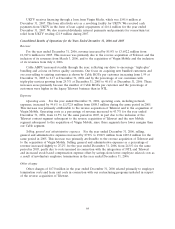

Please find page 56 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.instruments are required to be adopted by us in the first quarter of 2008 effective January 1, 2008.

While we are still addressing the impact of the adoption of this Standard it is not expected to have a

material impact on our consolidated financial statements.

In February 2007, the FASB issued Statement No. 159, The Fair Value Option for Financial Assets

and Financial Liabilities—Including an amendment of FASB Statement No. 115, or FAS 159. FAS 159

allows companies to elect to measure certain assets and liabilities at fair value and is effective for fiscal

years beginning after November 15, 2007. We are currently evaluating the effect that the adoption of

FAS 159 will have on our consolidated financial statements and are not yet in a position to determine

its effects.

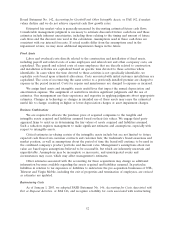

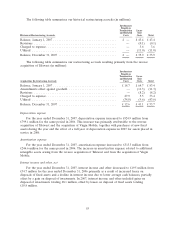

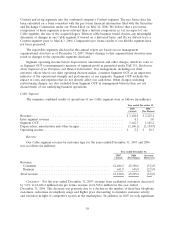

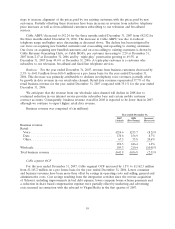

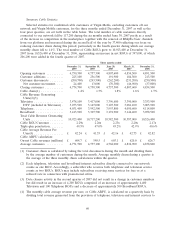

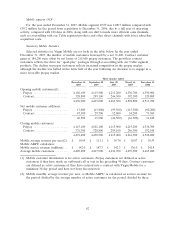

Consolidated Results of Operations from Continuing Operations

Consolidated Results of Operations for the Years Ended December 31, 2007 and 2006

Revenue

For the year ended December 31, 2007, revenue increased by 13.1% to £4,073.7 million from

£3,602.2 million for the year ended December 31, 2006. This increase was primarily due to the reverse

acquisition of Telewest and the inclusion of its revenues from March 3, 2006, and to the acquisition of

Virgin Mobile and the inclusion of its revenues from July 4, 2006, as compared to their inclusion for

the full year in 2007. Offsetting this has been an underlying decline in revenue in our Cable and

Content segments due to the factors described below in our segmental results of operations for the

years ended December 31, 2007 and 2006.

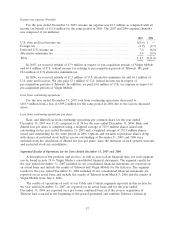

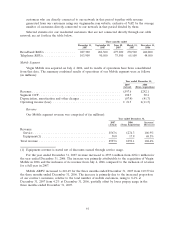

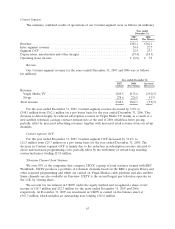

Expenses

Operating costs. For the year ended December 31, 2007, operating costs, including network

expenses, increased by 16.4% to £1,830.0 million from £1,572.8 million during the same period in 2006.

This increase was primarily attributable to the reverse acquisition of Telewest and to the acquisition of

Virgin Mobile. Operating costs as a percentage of revenue increased to 44.9% for the year ended

December 31, 2007 from 43.7% for the same period in 2006, due to a decline in gross margins in our

Cable segment together with the full year impact in 2007 of the inclusion of the Telewest Content

segment subsequent to the reverse acquisition of Telewest and the new Mobile segment subsequent to

the acquisition of Virgin Mobile, since these segments have lower gross margins than our Cable

segment.

Selling, general and administrative expenses. For the year ended December 31, 2007, selling,

general and administrative expenses increased by 5.9% to £960.2 million from £906.9 million for the

same period in 2006. This increase was primarily attributable to the reverse acquisition of Telewest and

to the acquisition of Virgin Mobile and higher marketing costs in connection with the Virgin Media

rebrand, partially offset by a reduction in our employee expenses as a result of our integration activities

together with lower company bonus scheme payments, a reduction in our share-based compensation

expense resulting primarily from stock and option forfeitures, lower bad debt expense due to

operational improvements in our billing and collections following the integration of our systems and

processes, and gains resulting from the settlement of certain contractual issues.

Other charges

Other charges of £28.7 million in the year ended December 31, 2007 and £67.0 million in the year

ended December 31, 2006 related primarily to employee termination costs and lease exit costs in

connection with our restructuring programs initiated in respect of the reverse acquisition of Telewest.

54