Virgin Media 2007 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

5. Acquisitions (Continued)

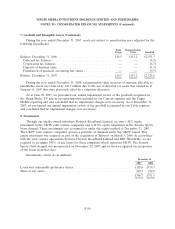

Amortizable intangible assets

Of the total purchase price, £295.3 million was allocated to amortizable intangible assets including

customer lists and contractual relationships. Customer lists represent existing contracts that relate

primarily to underlying customer relationships pertaining to the services provided by Virgin Mobile.

The fair value of these assets was determined utilizing the income approach. We amortize the fair value

of these assets on a straight-line basis over an average estimated useful life of 3.5 years.

Contractual relationships represented the fair value of certain contracts with distributors of our

products and services. The fair value of these contracts was determined utilizing the income approach.

We amortize the fair value of these assets on a straight-line basis over the remaining life of the

contracts of three years.

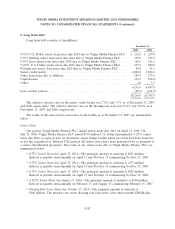

Reverse Acquisition of Telewest

On March 3, 2006, Virgin Media merged with Telewest and the merger was accounted for as a

reverse acquisition of Telewest using the purchase method. This merger created the U.K.’s largest

provider of residential broadband and the U.K.’s leading provider of ‘‘triple-play’’ services. In

connection with this transaction, Telewest changed its name to NTL Incorporated, and has since

changed its name to Virgin Media Inc.

On June 19, 2006, in connection with the integration of Virgin Media and Telewest, we engaged in

a post acquisition restructuring of Telewest UK Limited and its subsidiaries in order to integrate their

operations with Virgin Media’s existing U.K. operations and to implement permanent financing. This

restructuring involved a series of steps that included internal contributions, distributions, mergers and

acquisitions as well as borrowings from external sources and contributions of the proceeds of the same

to us, to effect our acquisition of the shares of Telewest UK Limited and its subsidiaries. The

completion of this restructuring resulted in Telewest UK Limited and its subsidiaries becoming our

wholly-owned subsidiary. We have accounted for the acquisition of Telewest UK Limited and its

subsidiaries by applying the principles of FAS 141, Business Combinations in respect to transactions

between entities under common control. As a result, the assets acquired and liabilities assumed have

been recognized at their historical cost and the results of operations and cashflows for Telewest UK

Limited are included in our consolidated financial statements from June 19, 2006, the date the

restructuring was completed.

F-82