Virgin Media 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

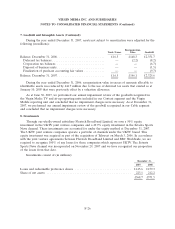

12. Stock-Based Compensation Plans (Continued)

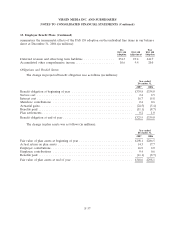

A summary of the status of our stock option grants outstanding as of December 31, 2007, and of

the changes during the year ended December 31, 2007, is given below.

Weighted

Average

Exercise

Options Price

Outstanding—beginning of year .................................... 13,055,630 $19.31

Granted ..................................................... 3,737,782 24.65

Exercised .................................................... (3,298,250) 10.96

Forfeited or expired ............................................ (2,690,185) 25.04

Outstanding—end of year ........................................ 10,804,977 22.40

Exercisable at end of the year ..................................... 3,800,027 $18.47

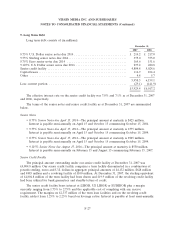

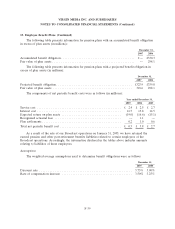

The weighted-average grant-date fair value of options granted during the years ended

December 31, 2007, 2006 and 2005, excluding options converted on the merger with Telewest, was

$7.08, $7.76, and $9.56, respectively. The weighted-average grant-date fair value of options granted

during the year 2006 including options converted on the merger was $11.46. The total intrinsic value of

options exercised during the years ended December 31, 2007, 2006, and 2005, was £23.4 million,

£47.1million, and £17.7 million, respectively.

The aggregate intrinsic value of options outstanding as at December 31, 2007 was £8.0 million with

a weighted average remaining contractual term of 8.1 years. The aggregate intrinsic value of options

exercisable as at December 31, 2007 was £6.9 million with a weighted average remaining contractual

term of 7.0 years.

Non-vested Shares

As a result of the reverse acquisition of Telewest, each share of our common stock issued and

outstanding immediately prior to the effective date of the acquisition was converted into the right to

receive 2.5 shares of the new parent company.

A summary of the status of the company’s non-vested shares as of December 31, 2007, and of

changes during the year ended December 31, 2007, is given below.

Weighted

Average

Grant-date

Shares Fair value

Non-vested—beginning of year .................................... 2,435,396 $25.77

Granted ..................................................... 128,150 24.76

Vested ...................................................... (628,554) 26.02

Forfeited or expired ............................................ (532,083) 27.53

Non-vested—end of year ......................................... 1,402,909 $24.89

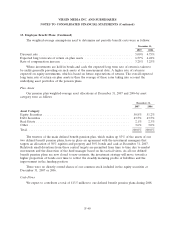

As of December 31, 2007, there was £2.7 million of total unrecognized compensation cost related

to non-vested share-based compensation arrangements granted for which a measurement date has been

F-35