Virgin Media 2007 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative Financial Instruments and Hedging Activities (Continued)

The principal obligations under the $550 million 9.125% senior notes due 2016, the A225 million

senior notes due 2014 and the $628 million and A485 million principal obligations under the senior

credit facility are hedged with cross-currency interest rate swaps.

11. Fair Values of Financial Instruments

In estimating the fair value of our financial instruments, we used the following methods and

assumptions:

Cash and cash equivalents, and restricted cash: The carrying amounts reported in the consolidated

balance sheets approximate fair value due to the short maturity and nature of these financial

instruments.

Long term debt: The carrying amount of the senior credit facility approximates its fair value due

to the fact that this debt instrument pays a floating rate of interest based upon market rates that are

reset semi-annually. The fair values of our other debt in the following table are based on the quoted

market prices.

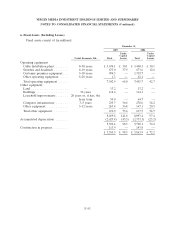

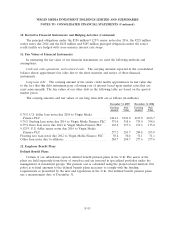

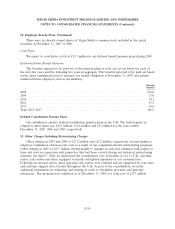

The carrying amounts and fair values of our long term debt are as follows (in millions):

December 31, 2007 December 31, 2006

Carrying Fair Carrying Fair

Amount Value Amount Value

8.75% U.S. dollar loan notes due 2014 to Virgin Media

Finance PLC ..................................... £214.2 £221.0 £217.0 £226.7

9.75% Sterling loan notes due 2014 to Virgin Media Finance PLC 375.0 358.6 375.0 398.6

8.75% Euro loan notes due 2014 to Virgin Media Finance PLC . . 165.6 157.6 151.6 173.2

9.125% U.S. dollar senior notes due 2016 to Virgin Media

Finance PLC ..................................... 277.2 283.7 280.8 295.9

Floating rate loan notes due 2012 to Virgin Media Finance PLC . 50.4 50.4 51.1 51.1

Other loan notes due to affiliates ........................ 284.7 284.7 277.6 277.6

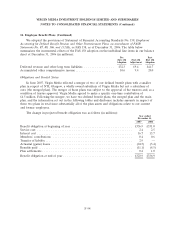

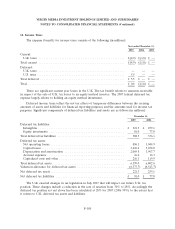

12. Employee Benefit Plans

Defined Benefit Plans

Certain of our subsidiaries operate defined benefit pension plans in the U.K. The assets of the

plans are held separately from those of ourselves and are invested in specialized portfolios under the

management of investment groups. The pension cost is calculated using the projected unit method. Our

policy is to fund amounts to the defined benefit plans necessary to comply with the funding

requirements as prescribed by the laws and regulations in the U.K. Our defined benefit pension plans

use a measurement date of December 31.

F-93