Virgin Media 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

over time. As a result, we will need to continue to improve our operating performance over the next

several years to meet these levels. Failure to meet these covenant levels would result in a default under

our senior credit facility.

Debt Ratings

To access public debt capital markets, we rely on credit rating agencies to assign corporate credit

ratings. A rating is not a recommendation by the rating agency to buy, sell or hold our securities. A

credit rating agency may change or withdraw our ratings based on its assessment of our current and

future ability to meet interest and principal repayment obligations. Lower credit ratings generally result

in higher borrowing costs and reduced access to debt capital markets. The corporate debt ratings and

outlook currently assigned by the rating agencies engaged by us are as follows:

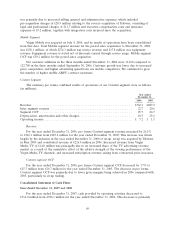

Corporate

Rating Outlook

Moody’s Investors Service Inc. ..................................... Ba3 Negative

Standard & Poor’s .............................................. B+ Stable

On August 9, 2007, Moody’s changed the outlook for Virgin Media to ‘‘Negative’’, citing increased

competitive pressure in the telephony and mobile businesses. The Company’s ratings were unchanged.

On November 15, 2007, Standard & Poor’s raised the outlook for Virgin Media to ‘‘Stable’’, and

affirmed the Company’s ratings.

Cash Dividends

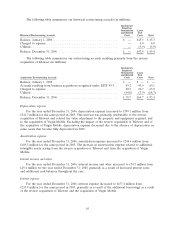

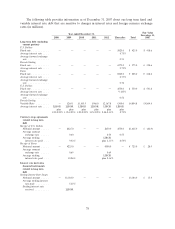

We commenced the payment of regular quarterly dividends in June 2006. During the years ended

December 31, 2007 and 2006, we paid the following dividends:

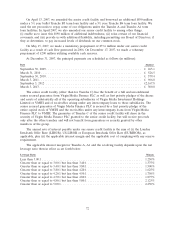

Per Share Total

Board Declaration Date Dividend Record Date Payment Date Amount

(in millions)

Year ended December 31, 2006:

May 18, 2006 ................ $0.01 June 12, 2006 June 20, 2006 £1.6

August 28, 2006 .............. 0.02 September 12, 2006 September 20, 2006 3.5

November 28, 2006 ............ 0.02 December 12, 2006 December 20, 2006 3.4

Year ended December 31, 2007:

February 27, 2007 ............. $0.02 March 12, 2007 March 20, 2007 £3.3

May 16, 2007 ................ 0.03 June 12, 2007 June 20, 2007 5.0

August 15, 2007 .............. 0.04 September 12, 2007 September 20, 2007 6.5

November 27, 2007 ............ 0.04 December 12, 2007 December 20, 2007 6.4

Future payments of regular quarterly dividends by us are at the discretion of the Board of

Directors and will be subject to our future needs and uses of cash, which could include investments in

operations, the repayment of debt, and share repurchase programs. In addition, the terms of our and

our subsidiaries’ existing and future indebtedness and the laws of jurisdictions under which those

subsidiaries are organized limit the payment of dividends, loan repayments and other distributions to us

under many circumstances.

Off-Balance Sheet Arrangements

As of December 31, 2007, we had no off-balance sheet arrangements.

74