Virgin Media 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. Derivative Financial Instruments and Hedging Activities (Continued)

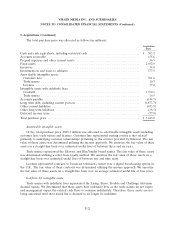

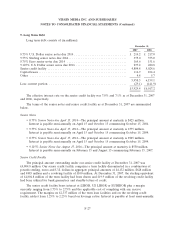

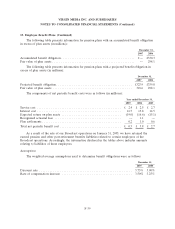

The gains or losses on derivative instruments recognized through the statement of operations and

statement of accumulated other comprehensive income were as follows (in millions):

December 31,

2007 2006 2005

Net settlements (losses) gains included within interest expense:

Interest rate swaps ........................................... £ 11.9 £ (24.7) £ (5.1)

Cross-currency interest rate swaps ................................ (16.7) (5.0) (4.2)

£ (4.8) £ (29.7) £ (9.3)

Changes in fair value included within accumulated other comprehensive income:

Interest rate swaps ........................................... £ (0.1) £ 10.9 £ 13.1

Cross-currency interest rate swaps ................................ 53.9 (60.7) 10.1

£ 53.8 £ (49.8) £ 23.2

Changes in fair value included within (losses) gains on derivative instruments:

Interest rate swap ineffectiveness ................................ £ 8.1 £ 0.8 £ —

Cross-currency interest rate swap ineffectiveness ..................... 1.5 (1.5) —

Derivative instruments not designated as hedges ..................... (12.1) 2.0 0.9

£ (2.5) £ 1.3 £ 0.9

Changes in fair value included within foreign currency transactions gains

(losses):

Cross-currency interest rate swaps ................................ £ 0.2 £ (4.1) £ —

Foreign currency forward rate contracts ............................ (4.0) (72.0) 62.8

£ (3.8) £ (76.1) £ 62.8

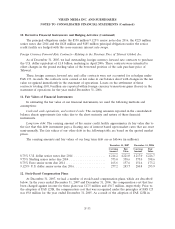

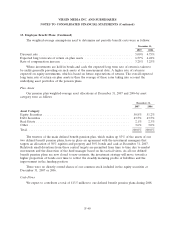

During 2006 we entered into a number of interest rate swaps to fix at least two-thirds of the

interest payments on our current financing arrangements. On October 2, 2005, we and VMIH entered

into an agreement with several financial institutions to provide financing in connection with the merger

agreement with Telewest. As a result of this agreement, we discontinued the hedge designation on

October 2, 2005 for the interest rate swaps with notional amounts totaling £2,315 million, $545 million

and A251 million related to the interest payments on the then outstanding senior debt facilities. Net

unrealized losses of £9.1 million, which had been included in other comprehensive income at

September 30, 2005, were reclassified to earnings and net unrealized gains of £6.7 million and

£2.0 million were taken directly to earnings in the final quarter of 2005 and year ended December 31,

2006, respectively. These instruments expire on dates between April 2007 and December 2013 and have

not been re-designated as hedges for accounting purposes.

Interest Rate Swaps—Hedging of Interest Rate Sensitive Obligations

As of December 31, 2007, we have outstanding interest rate swap agreements to manage the

exposure to variability in future cash flows on the interest payments associated with £3,184 million of

our outstanding senior credit facility, which accrue at variable rates based on LIBOR. The interest rate

swaps allow us to receive interest based on three and six month LIBOR in exchange for payments of

F-31