Virgin Media 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

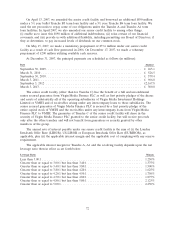

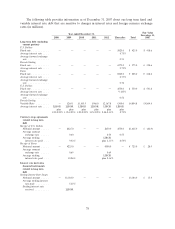

The applicable interest margins for Tranche B and Tranche C are as follows:

Facility Margin

B1................................................................... 2.125%

B2................................................................... 2.125%

B3................................................................... 2.000%

B4................................................................... 2.000%

B5................................................................... 2.125%

B6................................................................... 2.125%

C ................................................................... 2.750%

Senior Notes

On July 25, 2006, Virgin Media Finance PLC issued U.S. dollar denominated 9.125% senior notes

due 2016 with a principal amount outstanding of $550 million. The senior notes due 2016 are

unsecured senior obligations of Virgin Media Finance PLC and rank pari passu with Virgin Media

Finance’s outstanding senior notes due 2014. The senior notes due 2016 bear interest at an annual rate

of 9.125% payable on February 15 and August 15 of each year, beginning February 15, 2007. The

senior notes due 2016 mature on August 15, 2016 and are guaranteed by Virgin Media, Virgin Media

Group LLC, VMIH and certain other intermediate holding companies of Virgin Media.

The U.S. dollar denominated 8.75% senior notes due 2014 were issued by Virgin Media

Finance PLC on April 13, 2004 and have a principal amount outstanding of $425 million. The sterling

denominated 9.75% senior notes due 2014 were issued by Virgin Media Finance PLC on April 13, 2004

and have a principal amount outstanding of £375 million. The euro denominated 8.75% senior notes

due 2014 were issued by Virgin Media Finance PLC on April 13, 2004 and have a principal amount

outstanding of A225 million. The senior notes due 2014 mature on April 15, 2014 and are guaranteed

by Virgin Media, Virgin Media Group LLC, VMIH and certain of the intermediate holding companies

in the group.

Restrictions under our Existing Debt Agreements

The agreements governing the senior notes and the senior credit facility significantly and, in some

cases absolutely, restrict our ability and the ability of most of our subsidiaries to:

• incur or guarantee additional indebtedness;

• pay dividends or make other distributions, or redeem or repurchase equity interests or

subordinated obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• enter into sale and leaseback transactions or certain vendor financing arrangements;

• create liens;

• enter into agreements that restrict the restricted subsidiaries’ ability to pay dividends, transfer

assets or make intercompany loans;

• merge or consolidate or transfer all or substantially all of their assets; and

• enter into transactions with affiliates.

We are also subject to financial maintenance covenants under our senior credit facility. These

covenants require us to meet financial covenants on a quarterly basis and the required levels increase

73