Virgin Media 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

16. Related Party Transactions (Continued)

During the year ended December 31, 2007 and the period from March 3, 2006 to December 31,

2006, we received cash payments from UKTV for loan principal payments, interest, dividends and

consortium tax relief totaling £38.3 million and £31.6 million, respectively.

17. Shareholders’ Equity

Authorized Share Capital

Our authorized share capital for issuance consists of one billion shares of common stock,

300.0 million shares of Class B redeemable common stock and five million shares of preferred stock

with a par value of $0.01 each. As at December 31, 2007, there were 327.5 million shares of common

stock outstanding, and no Class B redeemable common stock or preferred stock outstanding. The

common stock is voting with rights to dividends as declared by the Board of Directors.

In connection with the reverse acquisition of Telewest, each share of our common stock issued and

outstanding immediately prior to the effective time of the acquisition was converted into the right to

receive 2.5 shares of the new parents entity’s common stock. On March 3, 2006, we issued 212,931,048

shares of common stock for this purpose. For accounting purposes, the acquisition of Telewest has been

treated as a reverse acquisition. Accordingly, the 212,931,048 shares issued to acquire Virgin Media

Holdings have been treated as outstanding from January 1, 2004 (as adjusted for historical issuances

and repurchases during the period from January 1, 2004 to March 3, 2006). In addition, on March 3,

2006, each share of Telewest’s common stock issued and outstanding immediately prior to the

acquisition was converted into 0.2875 shares of the new parent entity’s common stock (and redeemable

stock that was redeemed). These 70,728,375 shares of new common stock have been treated as issued

on the acquisition date.

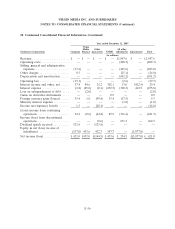

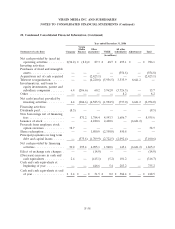

In accordance with the preceding paragraph, the outstanding shares as of December 31, 2005 and

weighted average shares outstanding for the year ended December 31, 2005 were restated as follows

(in millions, except share exchange ratio):

December 31,

2005

Weighted average shares outstanding as previously reported ...................... 85.1

Share exchange ratio in reverse acquisition ................................... 2.5

Weighted average shares outstanding, as restated .............................. 212.8

F-48