Virgin Media 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

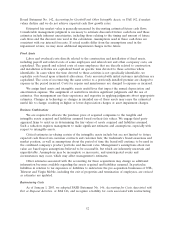

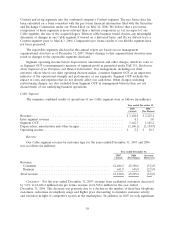

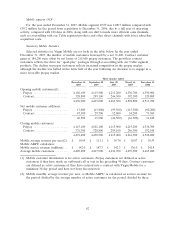

Income tax expense (benefit)

For the year ended December 31, 2007, income tax expense was £2.5 million as compared with an

income tax benefit of £11.8 million for the same period in 2006. The 2007 and 2006 expense (benefit)

was composed of (in millions):

2007 2006

U.S. state and local income tax ......................................... £(0.6) £ —

Foreign tax ........................................................ (4.9) (2.7)

Deferred U.S. income tax ............................................. 7.6 (8.6)

Alternative minimum tax .............................................. 0.4 (0.5)

Total ............................................................ £2.5 £(11.8)

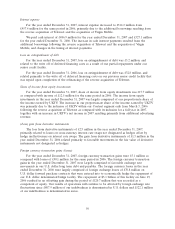

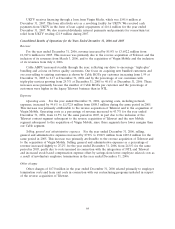

In 2007, we received refunds of £7.9 million in respect of pre-acquisition periods of Virgin Mobile

and £0.4 million of U.S. federal income tax relating to pre-acquisition periods of Telewest. We paid

£0.6 million of U.S alternative minimum tax.

In 2006, we received refunds of £1.3 million of U.S. alternative minimum tax and £0.1 million of

U.S. state and local tax. We also paid £3.1 million of U.S. federal income tax in respect of

pre-acquisition periods of Telewest. In addition, we paid £4.6 million of U.K. tax expense in respect of

pre-acquisition periods of Virgin Mobile.

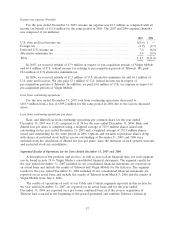

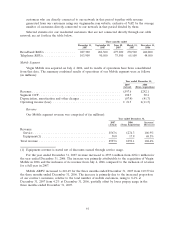

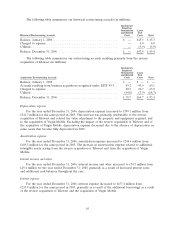

Loss from continuing operations

For the year ended December 31, 2007, loss from continuing operations decreased to

£463.5 million from a loss of £509.2 million for the same period in 2006 due to the factors discussed

above.

Loss from continuing operations per share

Basic and diluted loss from continuing operations per common share for the year ended

December 31, 2007 was £1.42 compared to £1.74 for the year ended December 31, 2006. Basic and

diluted loss per share is computed using a weighted average of 325.9 million shares issued and

outstanding in the year ended December 31, 2007 and a weighted average of 292.9 million shares

issued and outstanding for the same period in 2006. Options and warrants to purchase shares along

with shares of restricted stock held in escrow outstanding at December 31, 2007 and 2006 were

excluded from the calculation of diluted net loss per share, since the inclusion of such options, warrants

and restricted stock are anti-dilutive.

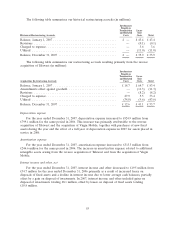

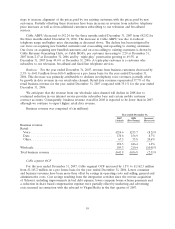

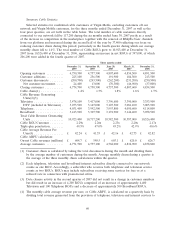

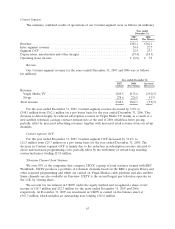

Segmental Results of Operations for the Years Ended December 31, 2007 and 2006

A description of the products and services, as well as year-to-date financial data, for each segment

can be found in note 19 to Virgin Media’s consolidated financial statements. The segment results for

the year ended December 31, 2007 included in our consolidated financial statements are reported on

an actual basis and include the results of Telewest and Virgin Mobile for the full year. The segment

results for the year ended December 31, 2006 included in our consolidated financial statements are

reported on an actual basis and include the results of Telewest from March 3, 2006 and the results of

Virgin Mobile from July 4, 2006.

The results of operations of each of our Cable and Content segments reported in this section for

the year ended December 31, 2007 are reported on an actual basis and for the year ended

December 31, 2006 are reported on a pro forma combined basis as if the reverse acquisition of

Telewest had occurred at the beginning of the period presented and combine Telewest’s historical

57