Virgin Media 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

15. Income Taxes (Continued)

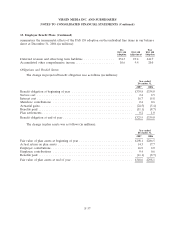

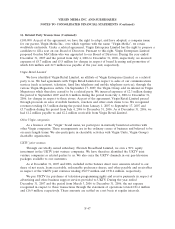

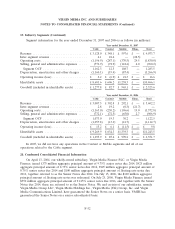

The reconciliation of income taxes computed at U.S. federal statutory rates to income tax (benefit)

expense is as follows (in millions):

Year ended December 31,

2007 2006 2005

Benefit at federal statutory rate (35%) ........................... £(161.3) £(182.7) £(77.7)

Add:

Permanent book-tax differences ................................ 19.7 31.1 39.1

Foreign losses with no benefit ................................. 122.7 92.6 69.9

U.S. losses with no benefit .................................... — 30.5 —

Difference between U.S. and foreign tax rates ..................... 21.9 16.7 12.5

State and local income tax .................................... (0.6) — (1.3)

Reduction in valuation allowance for U.S. deferred tax assets .......... — — (25.1)

Other ................................................... 0.1 — 1.4

Provision (benefit) for income taxes ............................. £ 2.5 £ (11.8) £ 18.8

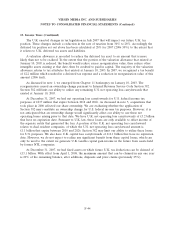

Effective January 1, 2007, we adopted FASB Interpretation No. 48, Accounting for Uncertainty in

Income Taxes—an interpretation of FASB Statement 109, or FIN 48. FIN 48 prescribes a comprehensive

model for recognizing, measuring, presenting and disclosing in the financial statements tax positions

taken or expected to be taken on a tax return, including a decision whether to file or not to file in a

particular jurisdiction. The adoption did not result in a cumulative effect adjustment and did not have a

material effect on our consolidated financial statements.

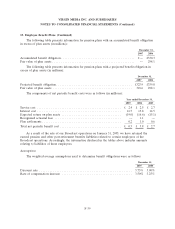

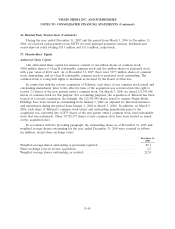

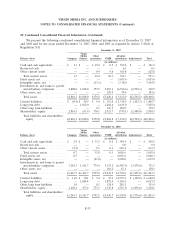

A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows

(in millions):

Balance at January 1, 2007 ............................................... £70.9

Additions based on tax positions related to the current year ...................... —

Additions for tax provisions of prior years ................................... 0.7

Reductions for tax provisions of prior years ................................. (56.3)

Reductions for lapse of applicable statute of limitation ......................... (0.3)

Settlements ......................................................... —

Balance at December 31, 2007 ............................................. £15.0

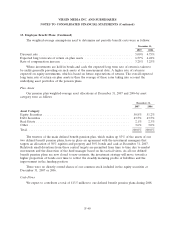

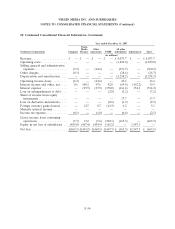

The total amount of unrecognized tax benefits as of December 31, 2007 and January 1, 2007 was

£15.0 million and £70.9 million, respectively. Included in the balance of unrecognized tax benefits as of

December 31, 2007 and January 1, 2007 are £0.8 million and £1.1 million that, if recognized, would

impact the effective tax rate. During 2007, we recognized £56.3 million of previously unrecognized tax

benefits due to a change in facts and circumstances. This had no impact on the effective tax rate due to

£2.4 million affecting goodwill, and £53.9 million having an offsetting valuation allowance. We also

recognized £0.3 million of previously unrecognized tax benefits as a result of the expiry of the

applicable statute of limitations. We do not expect that the amount of unrecognized tax benefits will

significantly increase or decrease in the next twelve months.

F-45