Virgin Media 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

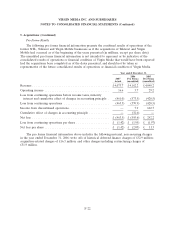

9. Long Term Debt

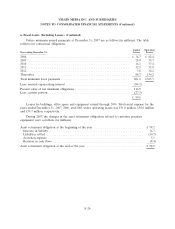

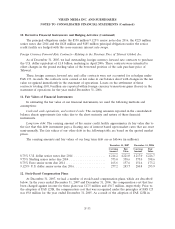

Long term debt consists of (in millions):

December 31,

2007 2006

8.75% U.S. Dollar senior notes due 2014 .............................. £ 214.2 £ 217.0

9.75% Sterling senior notes due 2014 ................................. 375.0 375.0

8.75% Euro senior notes due 2014 .................................. 165.6 151.6

9.125% U.S. Dollar senior notes due 2016 ............................. 277.2 280.8

Senior credit facility ............................................. 4,804.8 5,024.6

Capital leases .................................................. 116.9 104.4

Other ....................................................... 4.8 5.7

5,958.5 6,159.1

Less: current portion ............................................ (29.1) (141.9)

£ 5,929.4 £ 6,017.2

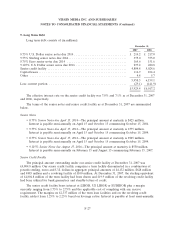

The effective interest rate on the senior credit facility was 7.8% and 7.1% as at December 31, 2007

and 2006, respectively.

The terms of the senior notes and senior credit facility as at December 31, 2007 are summarized

below.

Senior Notes

•8.75% Senior Notes due April 15, 2014—The principal amount at maturity is $425 million.

Interest is payable semi-annually on April 15 and October 15 commencing October 15, 2004.

•9.75% Senior Notes due April 15, 2014—The principal amount at maturity is £375 million.

Interest is payable semi-annually on April 15 and October 15 commencing October 15, 2004.

•8.75% Senior Notes due April 15, 2014—The principal amount at maturity is A225 million.

Interest is payable semi-annually on April 15 and October 15 commencing October 15, 2004.

•9.125% Senior Notes due August 15, 2016—The principal amount at maturity is $550 million.

Interest is payable semi-annually on February 15 and August 15 commencing February 15, 2007.

Senior Credit Facility

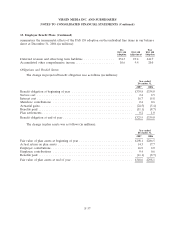

The principal amount outstanding under our senior credit facility at December 31, 2007 was

£4,804.8 million. Our senior credit facility comprises a term facility denominated in a combination of

pounds sterling, euros and U.S. dollars in aggregate principal amounts of £4,132 million, $628 million

and A485 million and a revolving facility of £100 million. At December 31, 2007, the sterling equivalent

of £4,804.8 million of the term facility had been drawn and £19.9 million of the revolving credit facility

had been utilized for bank guarantees and standby letters of credit.

The senior credit facility bears interest at LIBOR, US LIBOR or EURIBOR plus a margin

currently ranging from 1.75% to 2.75% and the applicable cost of complying with any reserve

requirement. The margins on £2,337 million of the term loan facilities and on the revolving credit

facility ratchet from 1.25% to 2.25% based on leverage ratios. Interest is payable at least semi-annually.

F-27