Virgin Media 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

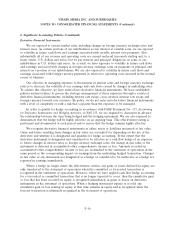

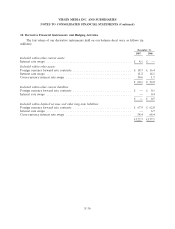

7. Goodwill and Intangible Assets (Continued)

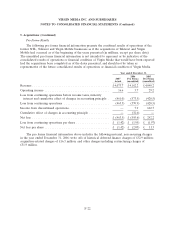

During the year ended December 31, 2007, assets not subject to amortization were adjusted for the

following (in millions):

Reorganization

Trade Names Value Goodwill

Balance, December 31, 2006 ........................... £16.5 £ 148.3 £ 2,351.7

Deferred tax balances .............................. — (2.2) (8.2)

Corporation tax balances ........................... — — (6.7)

Disposal of business units ........................... — — (1.5)

Finalization of purchase accounting fair values ............ — — (9.7)

Balance, December 31, 2007 ........................... £16.5 £ 146.1 £ 2,325.6

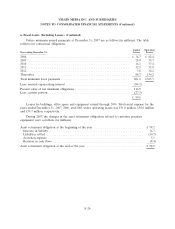

During the year ended December 31, 2006, reorganization value in excess of amounts allocable to

identifiable assets was reduced by £44.7 million due to the use of deferred tax assets that existed as at

January 10, 2003 that were previously offset by a valuation allowance.

As at June 30, 2007, we performed our annual impairment review of the goodwill recognized in

the Virgin Media TV and sit-up reporting units included in our Content segment and the Virgin

Mobile reporting unit and concluded that no impairment charges were necessary. As at December 31,

2007, we performed our annual impairment review of the goodwill recognized in our Cable segment

and concluded that no impairment charges were necessary.

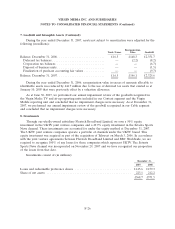

8. Investments

Through our wholly-owned subsidiary Flextech Broadband Limited, we own a 50% equity

investment in the UKTV joint venture companies and a 49.9% equity investment in the Setanta Sports

News channel. These investments are accounted for under the equity method at December 31, 2007.

The UKTV joint venture companies operate a portfolio of channels under the UKTV brand. This

equity investment was acquired as part of the acquisition of Telewest on March 3, 2006. In accordance

with the joint venture agreements between Flextech Broadband Limited and BBC Worldwide, we are

required to recognize 100% of any losses for those companies which represent UKTV. The Setanta

Sports News channel was incorporated on November 29, 2007 and we have recognized our proportion

of the losses from that date.

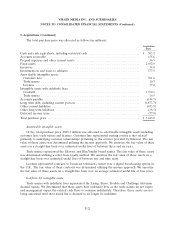

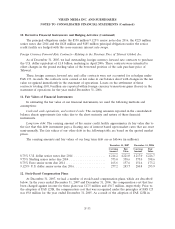

Investments consist of (in millions):

December 31,

2007 2006

Loans and redeemable preference shares ................................ £145.6 £ 159.3

Share of net assets ................................................ 223.1 212.2

£368.7 £371.5

F-26