Virgin Media 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

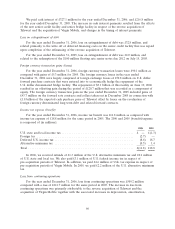

about Segments of an Enterprise and Related Information. Our management, including our chief

executive officer who is our chief operating decision maker, considers Segment OCF as an important

indicator of the operational strength and performance of our segments. Segment OCF excludes the

impact of costs and expenses that do not directly affect our cash flows. Other charges, including

restructuring charges, are also excluded from Segment OCF as management believes they are not

characteristic of our underlying business operations.

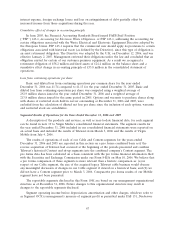

Cable Segment

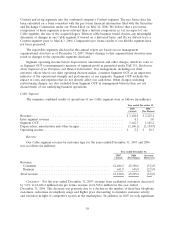

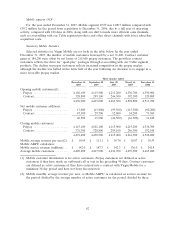

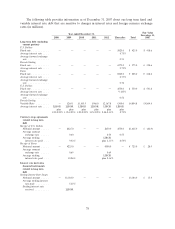

The summary pro forma combined results of operations of our Cable segment were as follows

(in millions):

Year ended December 31,

2006 2005

Revenue ..................................................... £3,225.4 £ 3,205.2

Inter segment revenue ........................................... 3.0 2.6

Segment OCF ................................................. 1,145.2 1,191.7

Depreciation, amortization and other charges .......................... (1,134.9) (1,139.6)

Operating income .............................................. £ 10.3 £ 52.1

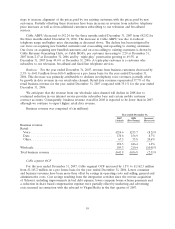

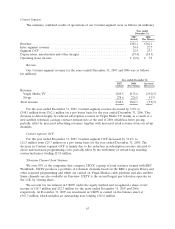

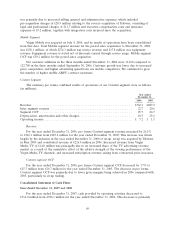

Revenue

Our pro forma Cable segment revenue by customer type for the years ended December 31, 2006

and 2005 was as follows (in millions):

Year ended December 31,

Increase/

2006 2005 (Decrease)

Revenue:

Consumer ........................................... £2,568.6 £2,527.4 1.6%

Business ............................................ 656.8 677.8 (3.1)%

Total revenue .......................................... £3,225.4 £3,205.2 0.6%

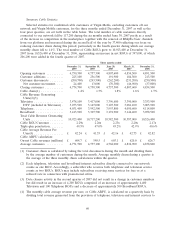

Consumer: For the year ended December 31, 2006, pro forma revenue from residential customers

increased by 1.6% to £2,568.6 million from £2,527.4 million for the year ended December 31, 2005.

This increase was driven largely by growth in the number of broadband internet subscribers together

with television and telephony price rises partially offset by lower telephony usage. Cable ARPU

increased steadily through the year, reflecting our drive to encourage triple-play bundling and a focus

on better quality customers. Our focus on acquiring new bundled customers and on cross-selling to

existing customers resulted in Cable RGUs per customer increasing from 2.06 on a pro forma basis at

December 31, 2005 to 2.17 at December 31, 2006 and by triple-play penetration growing from 32.4%

on a pro forma basis at December 31, 2005 to 40.6% at December 31, 2006.

Business: For the year ended December 31, 2006, pro forma revenue from business customers

decreased by 3.1% to £656.8 million from £677.8 million for the year ended December 31, 2005. This

decrease was attributable to declines in telephony voice revenue and lower wholesale and other

revenues, partially offset by greater data installation and rental revenue.

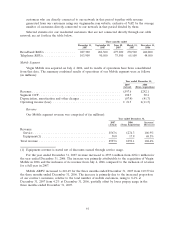

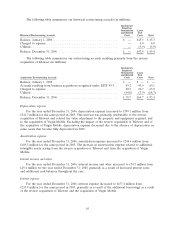

Cable segment OCF

For the year ended December 31, 2006, pro forma Cable segment OCF decreased by 3.9% to

£1,145.2 million from £1,191.7 million for the year ended December 31, 2005. The decrease in OCF

68