Virgin Media 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

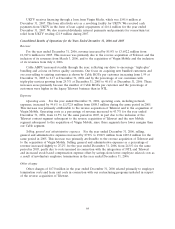

On April 13, 2007, we amended the senior credit facility and borrowed an additional £890 million

under a 51⁄2 year bullet Tranche B5 term loan facility and a 51⁄2 year Tranche B6 term loan facility. We

used the net proceeds to repay some of our obligations under the Tranche A and Tranche A1 term

loan facilities. In April 2007, we also amended our senior credit facility to among other things,

(i) enable us to issue this £890 million of additional indebtedness, (ii) relax certain of our financial

covenants, and (iii) provide us with additional flexibility, including permitting our Board of Directors, if

they so determine, to pay increased levels of dividends on our common stock.

On May 15, 2007, we made a mandatory prepayment of £73.6 million under our senior credit

facility as a result of cash flow generated in 2006. On December 17, 2007, we made a voluntary

prepayment of £200 million utilizing available cash reserves.

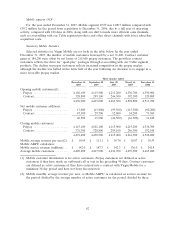

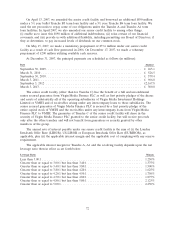

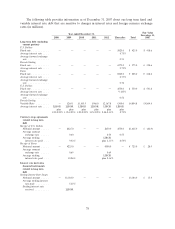

At December 31, 2007, the principal payments are scheduled as follows (in millions):

Date Amount

September 30, 2009 ...................................................... £ 265.1

March 31, 2010 ......................................................... £ 526.5

September 30, 2010 ...................................................... £ 579.4

March 3, 2011 .......................................................... £ 966.0

September 3, 2012 ...................................................... £2,167.8

March 3, 2013 .......................................................... £ 300.0

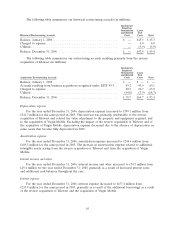

The senior credit facility (other than for Tranche C) has the benefit of a full and unconditional

senior secured guarantee from Virgin Media Finance PLC as well as first priority pledges of the shares

and assets of substantially all of the operating subsidiaries of Virgin Media Investment Holdings

Limited or VMIH and of receivables arising under any intercompany loans to those subsidiaries. The

senior secured guarantee of Virgin Media Finance PLC is secured by a first priority pledge of the

entire capital stock of VMIH and the receivables under any intercompany loans from Virgin Media

Finance PLC to VMIH. The guarantee of Tranche C of the senior credit facility will share in the

security of Virgin Media Finance PLC granted to the senior credit facility, but will receive proceeds

only after the other tranches and will not benefit from guarantees or security granted by other

members of the group.

The annual rate of interest payable under our senior credit facility is the sum of (i) the London

Intrabank Offer Rate (LIBOR), US LIBOR or European Intrabank Offer Rate (EURIBOR), as

applicable, plus (ii) the applicable interest margin and the applicable cost of complying with any reserve

requirement.

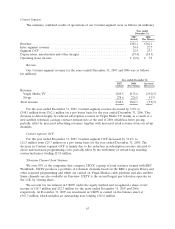

The applicable interest margin for Tranche A, A1 and the revolving facility depends upon the net

leverage ratio then in effect as set forth below:

Leverage Ratio Margin

Less than 3.00:1 ......................................................... 1.250%

Greater than or equal to 3.00:1 but less than 3.40:1 ............................... 1.375%

Greater than or equal to 3.40:1 but less than 3.80:1 ............................... 1.500%

Greater than or equal to 3.80:1 but less than 4.20:1 ............................... 1.625%

Greater than or equal to 4.20:1 but less than 4.50:1 ............................... 1.750%

Greater than or equal to 4.50:1 but less than 4.80:1 ............................... 1.875%

Greater than or equal to 4.80:1 but less than 5.00:1 ............................... 2.125%

Greater than or equal to 5.00:1 .............................................. 2.250%

72