Virgin Media 2007 Annual Report Download - page 104

Download and view the complete annual report

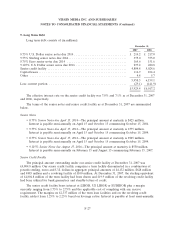

Please find page 104 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. Recent Accounting Pronouncements

In September 2006, the FASB issued Statement No. 157, Fair Value Measurements, or FAS 157.

FAS 157 provides guidance for using fair value to measure assets and liabilities. It also responds to

investors’ requests for expanded information about the extent to which companies measure assets and

liabilities at fair value, the information used to measure fair value, and the effect of fair value

measurements on earnings. FAS 157 applies whenever other standards require (or permit) assets or

liabilities to be measured at fair value, and does not expand the use of fair value in any new

circumstances. FAS 157 is effective for certain financial instruments included in financial statements

issued for fiscal years beginning after November 15, 2007 and for all other non-financial instruments for

fiscal years beginning after November 15, 2008. The provisions of FAS 157 relating to certain financial

instruments are required to be adopted by us in the first quarter of 2008 effective January 1, 2008.

While we are still addressing the impact of adoption of this Standard, it is not expected to have a

material impact on our consolidated financial statements.

In February 2007, the FASB issued Statement No. 159, The Fair Value Option for Financial Assets

and Financial Liabilities—Including an amendment of FASB Statement No. 115, or FAS 159. FAS 159

allows companies to elect to measure certain assets and liabilities at fair value and is effective for fiscal

years beginning after November 15, 2007. We are currently evaluating the effect that the adoption of

FAS 159 will have on our consolidated financial statements and are not yet in a position to determine

its effects.

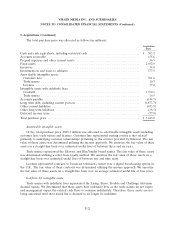

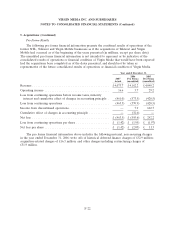

4. Discontinued Operations

On December 1, 2004, we reached an agreement to sell our Broadcast operations, a provider of

commercial television and radio transmission services, to a consortium led by Macquarie

Communications Infrastructure Group. The sale was completed on January 31, 2005. The results of

operations of the Broadcast operations have been removed from our results of continuing operations

and cash flows for all periods presented. Revenue of the Broadcast operations, reported in discontinued

operations, for the year ended December 31, 2005 was £21.4 million. Broadcast’s pre-tax income,

reported within discontinued operations, for the year ended December 31, 2005 was £3.2 million. Upon

the sale, we recorded a gain on disposal of £520.2 million.

On May 9, 2005, we sold our operations in the Republic of Ireland to MS Irish Cable

Holdings B.V., an affiliate of Morgan Stanley & Co. International Limited, for an aggregate purchase

price of A333.4 million, or £225.5 million. The results of operations and cash flows of the Ireland

operations have been removed from our results of continuing operations and cash flows for all periods

presented. Revenue of the Ireland operations, reported in discontinued operations, for the year ended

December 31, 2005 was £25.6 million. Ireland’s pre-tax income, reported within discontinued

operations, for the years ended December 31, 2006 and 2005 was £7.9 million and £2.5 million,

respectively. During the year ended December 31, 2006, we were able to release certain contingent tax

liabilities of £7.9 million, relating to the disposal of our former Ireland operations. Upon the sale, we

recorded a gain on disposal of £137.0 million, net of tax of £8.5 million.

F-18