Virgin Media 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.activities when the liability is incurred. The adoption of FAS 146 did not have a significant effect on

our results of operations, financial condition or cash flows.

Prior to 2003, we recognized a liability for costs associated with restructuring activities at the time

a commitment to restructure was given, in accordance with EITF 94-3, Liability Recognition for Certain

Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a

Restructuring), or EITF 94-3. Liabilities for costs associated with restructuring activities initiated prior to

January 1, 2003 continue to be accounted for under EITF 94-3.

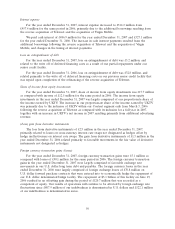

In relation to our restructuring activities, we have recorded a liability of £89.6 million as of

December 31, 2007 relating to lease exit costs of properties that we have vacated. In calculating the

liability, we make a number of estimates and assumptions including the timing of ultimate disposal of

the properties, our ability to sublet the properties either in part or as a whole, amounts of sublet rental

income achievable including any incentives required to be given to sublessees, amounts of lease

termination costs, and discount rates.

Income Taxes

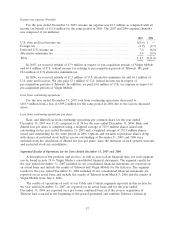

Our provision for income taxes is based on our current period income, changes in deferred income

tax assets and liabilities, income tax rates, and tax planning opportunities available in the jurisdictions

in which we operate. From time to time, we engage in transactions in which the tax consequences may

be subject to some uncertainty. Examples of such transactions include business acquisitions and

disposals, issues related to consideration paid or received in connection with acquisitions, and certain

financing transactions. Significant judgment is required in assessing and estimating the tax consequences

of these transactions. We prepare and file tax returns based on our interpretation of tax laws and

regulations and record estimates based on these judgments and interpretations.

At each period end, we make certain estimates and assumptions to compute the provision for

income taxes including, but not limited to, the expected operating income (or loss) for the year,

projections of the proportion of income (or loss) earned and taxed in the U.K. and the extent to which

this income (or loss) may also be taxed in the U.S., permanent and temporary differences, the

likelihood of deferred tax assets being recovered and the outcome of contingent tax risks. In the

normal course of business, our tax returns are subject to examination by various taxing authorities.

Such examinations may result in future tax and interest assessments by these taxing authorities for

uncertain tax positions taken in respect to matters such as business acquisitions and disposals and

certain financing transactions including intercompany transactions, amongst others, and we accrue a

liability when we believe an assessment is probable and the amount is estimable. In accordance with

GAAP, the impact of revisions to these estimates are recorded as income tax expense or benefit in the

period in which they become known. Accordingly, the accounting estimates used to compute the

provision for income taxes have and will change as new events occur, as more experience is acquired,

as additional information is obtained and as our tax environment changes.

Recent Accounting Pronouncements

In September 2006, the FASB issued Statement No. 157, Fair Value Measurements, or FAS 157.

FAS 157 provides guidance for using fair value to measure assets and liabilities. It also responds to

investors’ requests for expanded information about the extent to which companies measure assets and

liabilities at fair value, the information used to measure fair value, and the effect of fair value

measurements on earnings. FAS 157 applies whenever other standards require (or permit) assets or

liabilities to be measured at fair value, and does not expand the use of fair value in any new

circumstances. FAS 157 is effective for certain financial instruments included in financial statements

issued for fiscal years beginning after November 15, 2007 and for all other non-financial instruments for

fiscal years beginning after November 15, 2008. The provisions of FAS 157 relating to certain financial

53