Virgin Media 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

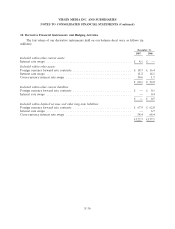

10. Derivative Financial Instruments and Hedging Activities (Continued)

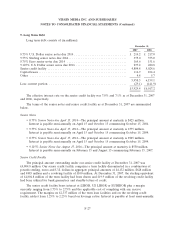

The principal obligations under the $550 million 9.125% senior notes due 2016, the A225 million

senior notes due 2014 and the $628 million and A485 million principal obligations under the senior

credit facility are hedged with the cross-currency interest rate swaps.

Foreign Currency Forward Rate Contracts—Relating to the Purchase Price of Telewest Global, Inc.

As of December 31, 2005, we had outstanding foreign currency forward rate contracts to purchase

the U.S. dollar equivalent of £1.8 billion, maturing in April 2006. These contracts were intended to

offset changes in the pound sterling value of the borrowed position of the cash purchase price of

Telewest.

These foreign currency forward rate and collar contracts were not accounted for as hedges under

FAS 133. As such, the contracts were carried at fair value in our balance sheet with changes in the fair

value recognized immediately in the statement of operations. Losses on the settlement of these

contracts totaling £101.0 million are reported within foreign currency transactions gains (losses) in the

statement of operations for the year ended December 31, 2006.

11. Fair Values of Financial Instruments

In estimating the fair value of our financial instruments, we used the following methods and

assumptions:

Cash and cash equivalents, and restricted cash: The carrying amounts reported in the consolidated

balance sheets approximate fair value due to the short maturity and nature of these financial

instruments.

Long term debt: The carrying amount of the senior credit facility approximates its fair value due to

the fact that this debt instrument pays a floating rate of interest based upon market rates that are reset

semi-annually. The fair values of our other debt in the following table are based on the quoted market

prices.

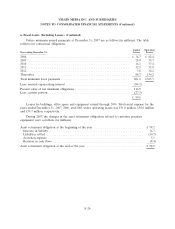

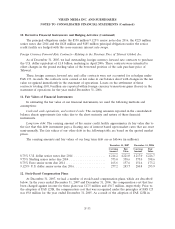

The carrying amounts and fair values of our long term debt are as follows (in millions):

December 31, 2007 December 31, 2006

Carrying Fair Carrying Fair

Amount Value Amount Value

8.75% U.S. dollar senior notes due 2014 .................. £214.2 £ 221.0 £ 217.0 £ 226.7

9.75% Sterling senior notes due 2014 ..................... 375.0 358.6 375.0 398.6

8.75% Euro senior notes due 2014 ....................... 165.6 157.6 151.6 173.2

9.125% U.S. dollar senior notes due 2016 .................. 277.2 283.7 280.8 295.9

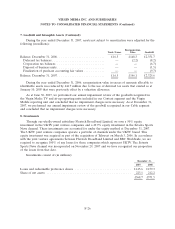

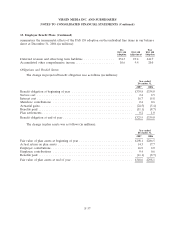

12. Stock-Based Compensation Plans

At December 31, 2007, we had a number of stock-based compensation plans, which are described

below. In the years ended December 31, 2007 and December 31, 2006, the compensation cost that has

been charged against income for these plans was £17.5 million and £36.7 million, respectively. Prior to

the adoption of FAS 123R, the compensation cost that was recognized under the principles of FAS 123

was £9.8 million for the year ended December 31, 2005. As a result of the adoption of FAS 123R in

F-33