Virgin Media 2007 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2007 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

17. Shareholders’ Equity (Continued)

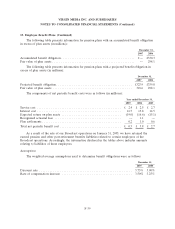

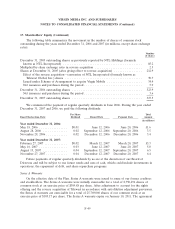

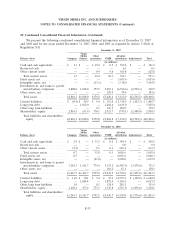

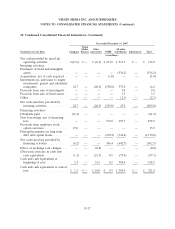

The following table summarizes the movement in the number of shares of common stock

outstanding during the years ended December 31, 2006 and 2007 (in millions, except share exchange

ratio):

Number

of shares

December 31, 2005 outstanding shares as previously reported by NTL Holdings (formerly

known as NTL Incorporated) ............................................. 85.2

Multiplied by share exchange ratio in reverse acquisition ........................... 2.5

Shares at December 31, 2005 (after giving effect to reverse acquisition) ................ 212.9

Effect of the reverse acquisition—conversion of NTL Incorporated (formerly known as

Telewest Global, Inc.) shares ............................................ 70.7

Issued under Scheme of Arrangement to acquire Virgin Mobile .................... 34.4

Net issuances and purchases during the period ................................. 5.9

December 31, 2006 outstanding shares ........................................ 323.9

Net issuances and purchases during the period ................................. 3.6

December 31, 2007 outstanding shares ........................................ 327.5

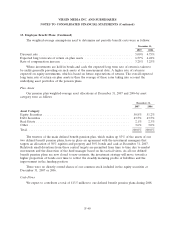

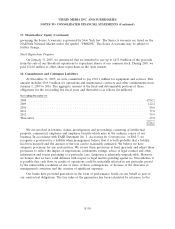

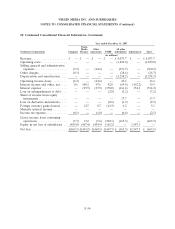

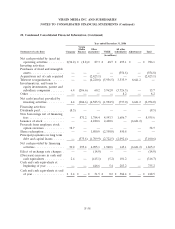

We commenced the payment of regular quarterly dividends in June 2006. During the year ended

December 31, 2007 and 2006, we paid the following dividends:

Per Share Total

Board Declaration Date: Dividend Record Date Payment Date Amount

(in millions)

Year ended December 31, 2006:

May 18, 2006 ................ $0.01 June 12, 2006 June 20, 2006 £1.6

August 28, 2006 .............. 0.02 September 12, 2006 September 20, 2006 3.5

November 28, 2006 ............ 0.02 December 12, 2006 December 20, 2006 3.4

Year ended December 31, 2007:

February 27, 2007 ............. $0.02 March 12, 2007 March 20, 2007 £3.3

May 16, 2007 ................ 0.03 June 12, 2007 June 20, 2007 5.0

August 15, 2007 .............. 0.04 September 12, 2007 September 20, 2007 6.5

November 27, 2007 ............ 0.04 December 12, 2007 December 20, 2007 6.4

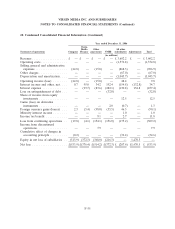

Future payments of regular quarterly dividends by us are at the discretion of our Board of

Directors and will be subject to our future needs and uses of cash, which could include investments in

operations, the repayment of debt, and share repurchase programs.

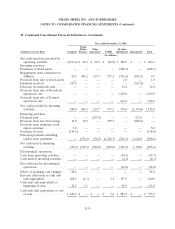

Series A Warrants

On the effective date of the Plan, Series A warrants were issued to some of our former creditors

and stockholders. The Series A warrants were initially exercisable for a total of 8,750,496 shares of

common stock at an exercise price of $309.88 per share. After adjustment to account for the rights

offering and the reverse acquisition of Telewest in accordance with anti-dilution adjustment provisions,

the Series A warrants are exercisable for a total of 25,769,060 shares of our common stock at an

exercise price of $105.17 per share. The Series A warrants expire on January 10, 2011. The agreement

F-49