US Airways 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346

|

|

Table of Contents

AMERICA WEST AIRLINES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

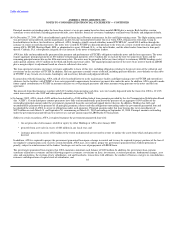

In the fourth quarter of 2003, IAC/InterActiveCorp completed its acquisition of Hotwire.com, a discount travel website. Hotwire was founded by the Texas

Pacific Group, American Airlines, Continental Airlines, Northwest Airlines, United Airlines, US Airways and AWA in October 2000. AWA had an

ownership interest of approximately 1.5% in Hotwire.com with a carrying value of approximately $0.03 million. Upon closing of the transaction, AWA

received cash of $9.8 million. Accordingly, AWA recognized a nonoperating gain of $9.8 million in the fourth quarter of 2003.

Under the airline compensation provisions of the Air Transportation Safety and System Stabilization Act (the "Act"), each air carrier was entitled to

receive the lesser of: (i) its direct and incremental losses for the period September 11, 2001 to December 31, 2001 or (ii) its proportional available seat mile

allocation (based on available seat miles for August 2001) of the $4.5 billion compensation available under the Act. In 2001, AWA received $98.2 million

under the Act from the United States government and expected to receive, based on its losses and its share of available seat miles, at least an additional

$10.0 million. In accordance with EITF Issue No. 01-10, "Accounting for the Impact of the Terrorist Attacks of September 11, 2001," AWA recognized

$108.2 million of federal government assistance in 2001 as nonoperating income because direct and incremental losses incurred during 2001 exceeded that

amount. In July 2002, AWA received an additional $12.3 million under the Act. Accordingly, $10.0 million was credited against the receivable established in

2001 and $2.3 million was recognized as nonoperating income in the second quarter of 2002. In August 2002, AWA received an additional payment of

$6.2 million under the Act, which was recognized as nonoperating income in the third quarter of 2002.

In March 2002, AWA wrote down its investment in Aeroxchange, an e-commerce entity, which was carried at cost, to net realizable value recognizing a

loss of $2.8 million.

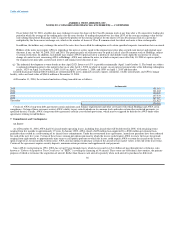

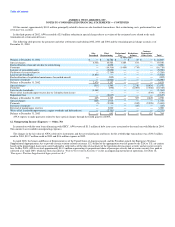

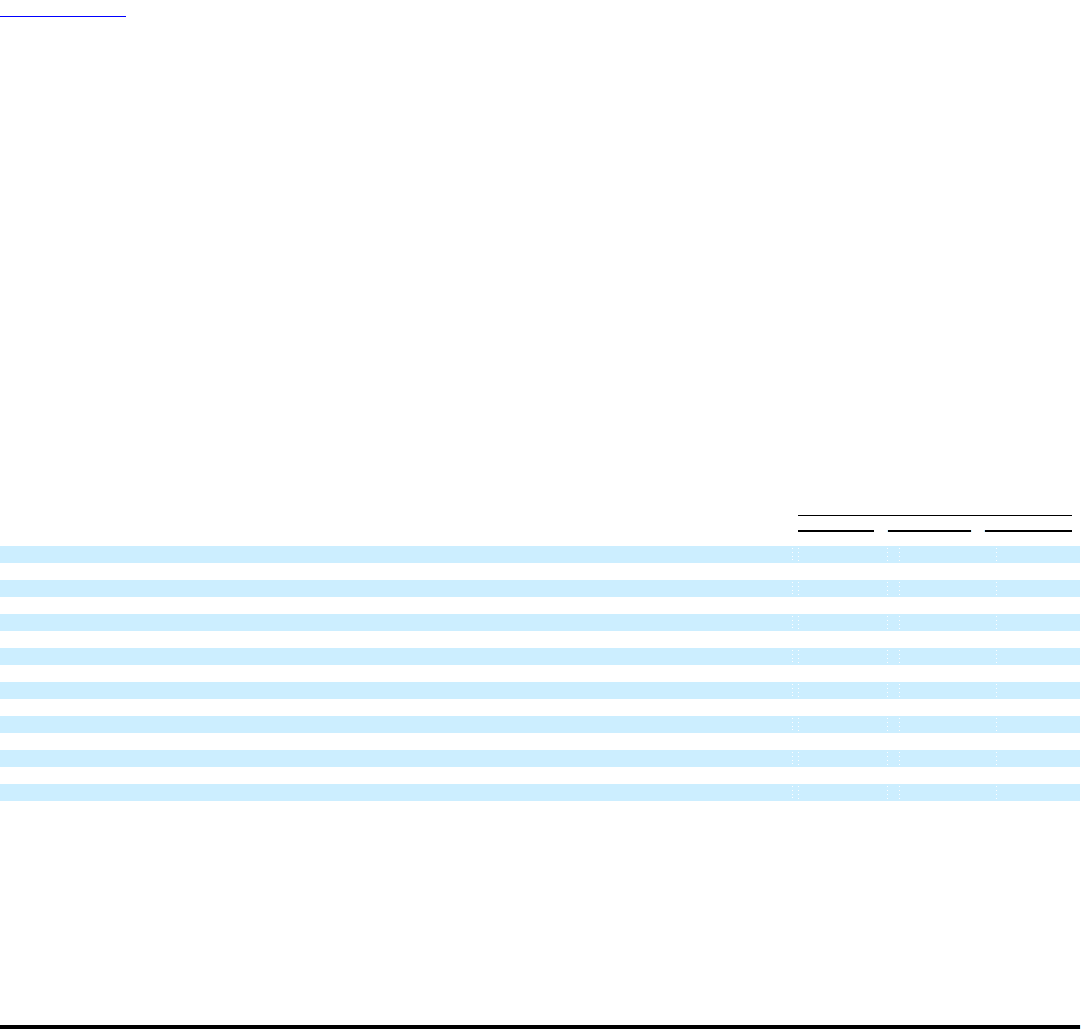

13. Supplemental Information to Statements of Cash Flows

Supplemental disclosure of cash flow information and non-cash investing and financing activities were as follows:

Year Ended December 31,

2004 2003 2002

(in thousands)

Non-cash transactions:

Reclassification of investments in debt securities to short-term investments $ 25,730 $ 29,058 $ —

Reclassification of advances to parent company, net — — 265,810

Issuance of convertible notes — — 67,902

Cancellation of convertible notes — (660) (8,280)

Cancellation of 10.75% senior unsecured notes related to sale of NLG investment — (10,370) —

Issuance of warrants — — 35,383

Exercise of warrants (2) (17) —

Equipment acquired through capital leases — — 17,753

Equipment acquired with issuance of notes payable — — 64,163

Notes payable issued for equipment purchase deposits 17,500 5,250 10,500

Notes payable canceled under the aircraft purchase agreement (7,000) (7,000) (10,500)

Payment in kind notes issued, net of returns 9,033 8,972 7,756

Cash transactions:

Interest paid, net of amounts capitalized 23,841 17,201 25,942

Income taxes paid (refunded) 367 (2,493) (63,503)

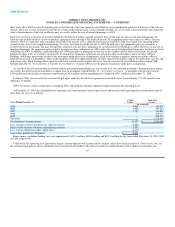

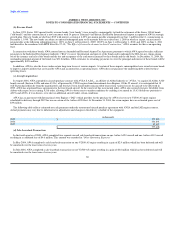

14. Related Party Transactions

As part of our reorganization in 1994, Continental Airlines and AWA entered into an alliance agreement that included code sharing arrangements,

reciprocal frequent flyer programs and ground handling operations. In March 2002, AWA received notice from Continental of its intention to terminate the

code sharing and frequent flyer agreements between the two airlines, effective April 26, 2002. Two of Continental's directors are managing partners of Texas

Pacific Group, which, through TPG Advisors, Inc., effectively controls the voting power of Holdings. AWA paid Continental approximately $13.4 million,

$17.3 million and $25.5 million and also received approximately $4.1 million, $5.0 million and $15.9 million in 2004, 2003 and 2002, respectively, from

Continental pursuant to these agreements.

94