US Airways 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346

|

|

Table of Contents

AMERICA WEST HOLDINGS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

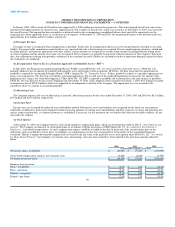

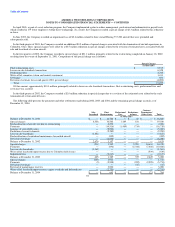

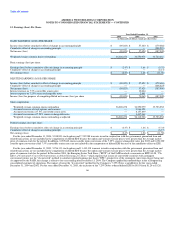

(c) Aircraft Acquisitions

In August 2004, AWA amended its aircraft purchase contract with AVSA S.A.R.L., an affiliate of Airbus Industrie or "AVSA," to acquire 22 Airbus A320

family aircraft (thirteen A320s and nine A319s), all powered by V2500 engines from International Aero Engines. Of the 22 aircraft, it is anticipated that 18

will be purchased directly from the manufacturer and four have been leased under noncancelable leases from various lessors for aircraft to be delivered in

2005. In the context of this incremental order, AWA also secured extensive flexibility from Airbus with respect to its existing A318 order, allowing AWA to

better react to market conditions by enabling it to amend its 15 A318 delivery positions to A319s and A320s, if it so desires, or to take no additional aircraft

under certain conditions.

The Company has an agreement with International Aero Engines or "IAE," which provides for the purchase by the Company of seven new V2500-A5

spare engines scheduled for delivery through 2007 for use on certain of the Airbus A320 fleet. At December 31, 2004, the seven engines have an estimated

gross cost of $39 million.

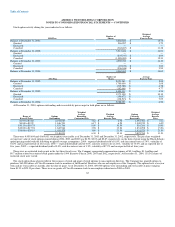

The following table reflects estimated net cash payments under the restructured aircraft purchase agreement with AVSA and the IAE engine contract.

Actual payments may vary due to inflation factor adjustments and changes in the delivery schedule of the equipment.

(in thousands)

2005 $ 272,820

2006 456,891

2007 47,697

$ 777,408

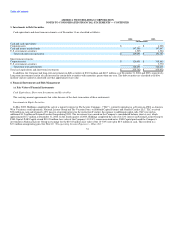

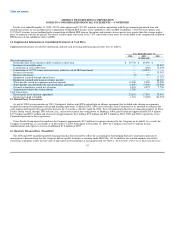

(d) Sale-Leaseback Transactions

In the fourth quarter of 2004, the Company completed two separate aircraft sale-leaseback transactions on one Airbus A320 aircraft and one Airbus A319

aircraft resulting in a combined loss of $4.6 million. This amount was recorded in "Other Operating Expenses."

In May 2004, the Company completed a sale-leaseback transaction on one V2500-A5 engine resulting in a gain of $2.9 million which has been deferred

and will be amortized over the lease term of seven years.

In July 2004, the Company completed a sale-leaseback transaction on one V2500-A5 engine resulting in a gain of $0.8 million which has been deferred

and will be amortized over the lease term of seven years.

As part of the restructuring completed on January 18, 2002, AWA committed to the sale and leaseback of eight aircraft. The sales and leaseback of six of

these aircraft were completed in 2002 and resulted in losses of approximately $3.8 million. The sale and leaseback of one aircraft was completed in June 2003

and resulted in a loss of approximately $0.6 million. The sale and leaseback of the final aircraft was completed in September 2003 and resulted in a loss of

approximately $0.7 million. The losses on the sale-leaseback transactions, which were subject to a firm commitment in January 2002, were accrued in the

accompanying consolidated statements of operations classified in "Special Charges" in the first quarter of 2002. See Note 11, "Special Charges."

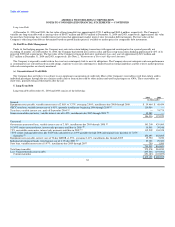

(e) Contingent Legal Obligations

Holdings and its subsidiaries are parties to various legal proceedings, including some purporting to be class action suits, and some that demand large

monetary damages or other relief, which, if granted, would require significant expenditures. In certain cases where it is probable that the outcome will result

in monetary damages, the Company has reviewed available information and determined that the best estimate of losses to be incurred related to these cases is

$2 million, which has been accrued. For those cases where a loss is possible, or cases where a range of loss is probable but no amount within the range is a

better estimate than any other amount, the estimated amount of additional exposure ranges from $0 to $25 million. In these instances, no accrual has been

recorded.

58