US Airways 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

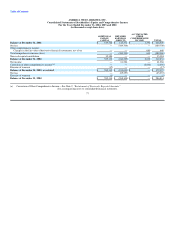

Table of Contents

AMERICA WEST AIRLINES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

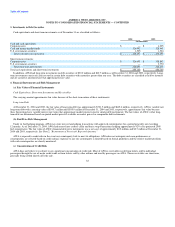

5. Advances to Parent Company and Affiliate

In January 2002, AWA closed a $429 million loan supported by a $380 million government loan guarantee. The terms of this loan and AWA's secured

term loan restrict Holdings' and AWA's ability to incur additional indebtedness or issue equity unless the proceeds of those transactions are used to prepay the

government guaranteed loan and the term loan. Accordingly, as a result of this transaction, AWA's net advances to Holdings have been classified in "Other

Assets" on AWA's balance sheet.

AWA's net advances to Holdings were approximately $258.8 million and $213.1 million at December 31, 2004 and 2003, respectively.

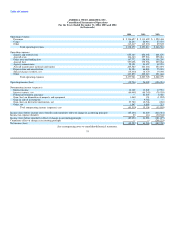

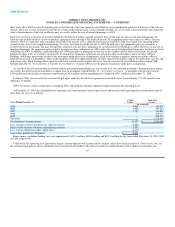

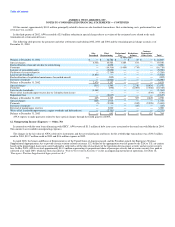

6. Long-Term Debt

Long-term debt at December 31, 2004 and 2003 consists of the following:

2004 2003

(in thousands)

Secured

Equipment notes payable, variable interest rates of 2.88% to 3.37%, averaging 2.96%, installments due 2005 through 2008 $ 39,464 $ 48,454

GECC term loan, variable interest rate of 6.41%, quarterly installments beginning 2006 through 2010 (a) 110,564 —

Term loan, variable interest rate, paid off September 2004 (a) — 74,775

Senior secured discount notes, variable interest rate of 6.42%, installments due 2005 through 2009 (b) 35,988 —

186,016 123,229

Unsecured

Government guaranteed loan, variable interest rate of 2.38%, installments due 2005 through 2008 (c) 343,200 429,000

10 3/4% senior unsecured notes, interest only payments until due in 2005 (d) 39,548 39,548

7.5% convertible senior notes, interest only payments until due in 2009 (e) 112,299 104,328

7.25% senior exchangeable notes, due 2023 with cash interest at 2.49% payable through 2008 and original issue discount of 7.25%

thereafter (f) 252,695 252,695

Equipment notes payable, interest rates of 90-day LIBOR +1.25%, averaging 3.61%, installments due through 2005 15,750 5,250

Industrial development bonds, fixed interest rate of 6.3% due 2023 (g) 29,300 29,300

State loan, variable interest rate of 5.97%, installments due 2005 through 2007 750 1,500

793,542 861,621

Total long-term debt 979,558 984,850

Less: Unamortized discount on debt (193,246) (191,986)

Current maturities (151,183) (103,899)

$ 635,129 $ 688,965

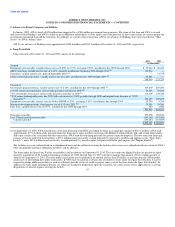

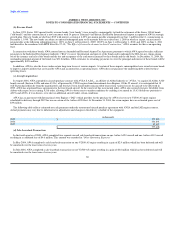

(a) On September 10, 2004, AWA entered into a term loan financing with GECC providing for loans in an aggregate amount of $110.6 million. AWA used

approximately $77.0 million of the proceeds from this financing to repay in full its term loan with Mizuho Corporate Bank, Ltd. and certain other lenders

and to pay certain costs associated with this transaction. AWA used the remaining proceeds for general corporate purposes. The new term loan financing

consists of two secured term loan facilities: a $75.6 million term loan facility secured primarily by spare parts, rotables and appliances (the "Spare Parts

Facility"); and a $35.0 million term loan facility secured primarily by aircraft engines and parts installed in such engines (the "Engine Facility").

The facilities are cross-collateralized on a subordinated basis and the collateral securing the facilities also secures on a subordinated basis certain of AWA's

other existing debt and lease obligations to GECC and its affiliates.

The loans under the Spare Parts Facility are payable in full at maturity on September 10, 2010. The loans under the Engine Facility are payable in equal

quarterly installments of $1.3 million beginning on March 10, 2006 through June 10, 2010 with the remaining loan amount of $11.8 million payable at

maturity on September 10, 2010. The loans under each facility may be prepaid in an amount not less than $5 million at any time after the 30th monthly

anniversary of the funding date under such facility. If AWA fails to maintain a certain ratio of rotables to loans under the Spare Parts Facility, it may be

required to pledge additional rotables or cash as collateral, provide a letter of credit or prepay some or all of the loans under the Spare Parts Facility. In

addition, the loans under the Engine Facility are subject to mandatory prepayment upon the occurrence of certain events of loss applicable to, or certain

dispositions of, aircraft engines securing the facility. 83