US Airways 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

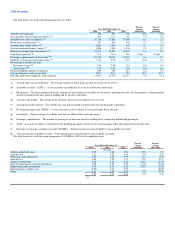

(7)

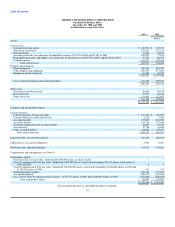

Includes $29.3 million of 6.3% industrial development bonds due April 2023.

(8)

Includes AVSA promissory notes of $15.8 million due 2005 with a variable interest rate of 3.61% at December 31, 2004.

(9)

Includes $36.0 million of senior secured discount notes due 2009 with a variable interest rate of 6.42% at December 31, 2004.

(10)

Includes non-cancelable operating leases for 136 aircraft with remaining terms ranging from five months to approximately 19 years. Management estimates

the debt equivalent value of these operating leases approximates $1.9 billion using an interest rate of 10%.

(11)

Includes leases for terminal space, ground facilities, the flight training center and computer and other equipment under non-cancelable operating leases.

(12)

Includes Series 1999 Terminal 4 Improvements Bonds, due 2019.

(13)

Includes commitments to purchase a total of 20 Airbus aircraft and seven spare engines for delivery in 2005 through 2007.

(14)

Includes minimum commitments under AWA's rate per engine hour agreement with General Electric Engine Services for overhaul maintenance services on

CFM56-3B engines through April 2008. Minimum monthly commitment amounts: for the period through and including April 2006 — $1.0 million, for the

period May 2006 through and including April 2008 — $250,000. These amounts reflect the termination agreement signed by AWA in late December 2004

which eliminates the V2500-A1 engines from the program.

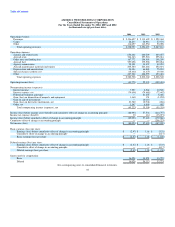

We expect to fund these cash obligations from funds provided by operations and future financings, if necessary. The cash available to us from these

sources, however, may not be sufficient to cover these cash obligations because economic factors outside our control may reduce the amount of cash

generated by operations or increase our costs. For instance, an economic downturn or general global instability caused by military actions, terrorism, disease

outbreaks and natural disasters could reduce the demand for air travel, which would reduce the amount of cash generated by operations. An increase in our

costs, either due to an increase in borrowing costs caused by a reduction in our credit rating or a general increase in interest rates or due to an increase in the

cost of fuel, maintenance, aircraft and aircraft engines and parts, could decrease the amount of cash available to cover the cash obligations. In addition, we

may be required to prepay portions of the government guaranteed loan if our employee compensation costs exceed a certain threshold and we may be required

to prepay portions of the term loan to the extent the value of the collateral securing the term loan decreases. In any of these cases, our liquidity may be

adversely affected and we may not have sufficient cash to prepay the government loan and meet our other obligations. Moreover, the government guaranteed

loan contains a $100 million minimum cash balance requirement. As a result, we cannot use all of our available cash to fund operations, capital expenditures

and cash obligations without violating this requirement.

Although there can be no assurances, management believes that cash flow from operating activities, coupled with existing cash balances and financing

commitments, will be adequate to fund the Company's operating and capital needs as well as enable it to maintain compliance with its various debt

agreements at least through December 31, 2005.

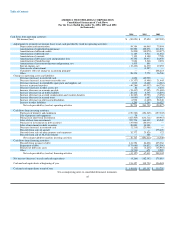

Financial Covenants and Credit Rating

In addition to the minimum cash balance requirements, our long-term debt agreements contain various negative covenants that restrict our actions,

including our ability to pay dividends, or make other restricted payments. Finally, our long-term debt agreements contain cross-default provisions, which may

be triggered by defaults by us under other agreements relating to indebtedness. See "Risk Factors Relating to the Company and Industry Related Risks — Our

high level of fixed obligations limits our ability to fund general corporate requirements and obtain additional financing, limits our flexibility in responding to

competitive developments and increases our vulnerability to adverse economic and industry conditions." As of December 31, 2004, Holdings and AWA were

in compliance with the covenants in their long-term debt agreements.

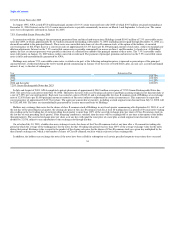

Our credit ratings are relatively low, with Moody's assessment of AWA's senior implied rating and senior unsecured debt rating at B3 and Caa2,

respectively, Standard & Poor's assessment of AWA's and Holdings' corporate credit ratings at B- and AWA's senior unsecured rating at CCC and Fitch

Ratings' assessment of AWA's long-term and unsecured debt rating at CCC. In addition, Standard & Poor's recently placed AWA's aircraft debt on

CreditWatch with negative implications as part of a broader review of aircraft-backed debt. Low credit ratings could cause our borrowing costs to increase,

which would increase our interest expense and could affect our net income and our credit ratings could adversely affect our ability to obtain additional

financing. The rating agencies

36