US Airways 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AMERICA WEST AIRLINES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

On or before July 30, 2018, a holder also may exchange its notes for shares of the Class B common stock at any time after a 10 consecutive trading-day

period in which the average of the trading prices for the notes for that 10 trading-day period was less than 103% of the average exchange value for the

notes during that period. Exchange value is equal to the product of the closing sale price for the shares of Class B common stock on a given day

multiplied by the then current exchange rate, which is the number of shares of Class B common stock for which each note is then exchangeable.

In addition, the holders may exchange the notes if the notes have been called for redemption or if certain specified corporate transactions have occurred.

Holders of the notes may require AWA to repurchase the notes at a price equal to the original issue price plus accrued cash interest and original issue

discount, if any, on July 30, 2008, 2013 and 2018. The purchase price of such notes may be paid in cash or class B common stock of Holdings, subject

to certain restrictions. In addition, each holder may require AWA to purchase all or a portion of such holder's notes upon the occurrence of certain

change of control events concerning AWA or Holdings. AWA may redeem the notes, in whole or in part, on or after July 30, 2008 at a price equal to

the original issue price plus accrued cash interest and original issue discount, if any.

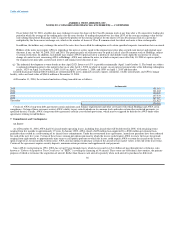

(g) The industrial development revenue bonds are due April 2023. Interest at 6.3% is payable semiannually (April 1 and October 1). The bonds are subject

to optional redemption prior to the maturity date on or after April 1, 2008, in whole or in part, on any interest payment date at the following redemption

prices: 102% on April 1 or October 1, 2008; 101% on April 1 or October 1, 2009; and 100% on April 1, 2010 and thereafter.

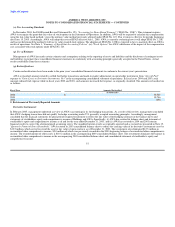

Secured financings totaling $186.0 million are collateralized by assets, primarily aircraft, engines, simulators, rotable aircraft parts and AWA's hangar

facility, with a net book value of $268.4 million at December 31, 2004.

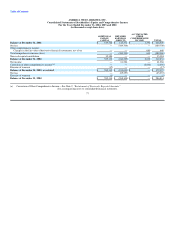

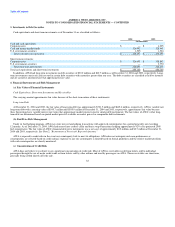

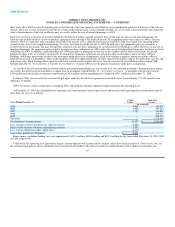

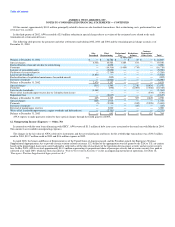

At December 31, 2004, the estimated maturities of long-term debt are as follows:

(in thousands)

2005 151,183

2006 101,042

2007 100,509

2008 107,570

2009 147,327

Thereafter 371,927

$ 979,558

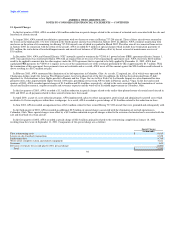

Certain of AWA's long-term debt agreements contain minimum cash balance requirements and other covenants with which Holdings and AWA are in

compliance. Certain of these covenants restrict AWA's ability to pay cash dividends on its common stock and make certain other restricted payments (as

specified therein). Finally, AWA's long-term debt agreements contain cross-default provisions, which may be triggered by defaults by AWA under other

agreements relating to indebtedness.

7. Commitments and Contingencies

(a) Leases

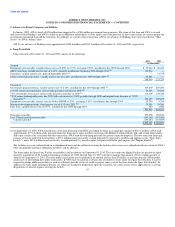

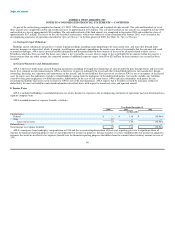

As of December 31, 2004, AWA had 136 aircraft under operating leases, including four aircraft that will be delivered in 2005, with remaining terms

ranging from five months to approximately 19 years. In January 2002, AWA closed a $429 million loan supported by a $380 million government loan

guarantee that resulted in a restructuring of its aircraft lease commitments. Under the restructured lease agreements, annual rent payments have been reduced

for each of the next five years. Certain of these leases contain put options pursuant to which the lessors could require AWA to renew the leases for periods

ranging from eight months to approximately nine years or call options pursuant to which the lessors could require AWA to return the aircraft to the lessors

upon receipt of six to nine months written notice. AWA also has options to purchase certain of the aircraft at fair market values at the end of the lease terms.

Certain of the agreements require security deposits, minimum return provisions and supplemental rent payments.

Since AWA's restructuring in 1994, AWA has set up 19 pass through trusts, which have issued over $1.4 billion of pass through trust certificates (also

known as "Enhanced Equipment Trust Certificates" or "EETC") covering the financing of 54 aircraft. These trusts are off-balance sheet entities, the primary

purpose of which is to finance the acquisition of aircraft. Rather than finance each aircraft separately when such aircraft is purchased or delivered,

86