US Airways 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AMERICA WEST HOLDINGS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

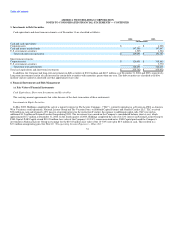

In January 2002, AWA closed a $429 million loan supported by a $380 million government loan guarantee. This loan triggered aircraft rent concessions

negotiated with approximately 20 aircraft lessors. Approximately $18.1 million of aircraft rent, which was accrued as of December 31, 2001, was waived by

the aircraft lessors. This amount has been recorded as a deferred credit in the accompanying consolidated balance sheet and will be amortized over the

remaining lives of the applicable leases as a reduction in rent expense. At December 31, 2004 and 2003, the unamortized balance of the deferred credit was

approximately $4.2 million and $7.8 million, respectively.

(j) Passenger Revenue

Passenger revenue is recognized when transportation is provided. Ticket sales for transportation that has not yet been provided are recorded as air traffic

liability. Passenger traffic commissions and related fees are expensed when the related revenue is recognized. Due to complex pricing structures, refund and

exchange policies, and interline agreements with other airlines, certain amounts are recognized in revenue using estimates regarding both the timing of the

revenue recognition and the amount of revenue to be recognized. These estimates are generally based on the statistical analysis of the Company's historical

data. Any adjustments resulting from periodic evaluations of the estimated air traffic liability are included in results of operations during the period in which

the evaluations are completed.

(k) Reorganization Value in Excess of Amounts Applicable to Identifiable Assets ("ERV")

In June 2001, the Financial Accounting Standards Board ("FASB") issued SFAS No. 412, "Goodwill and Other Intangible Assets." SFAS No. 142

primarily addresses the accounting for goodwill and intangible assets subsequent to their acquisition. SFAS No. 142 does not permit the amortization of

goodwill as required by Accounting Principles Board ("APB") Opinion No. 17, "Intangible Assets." Rather, goodwill is subject to a periodic impairment test,

using a two-step process. The first step is to identify a potential impairment. The second step of the goodwill impairment test measures the amount of the

Impairment loss, using a fair value-based approach. Under SFAS No. 142, ERV is reported as goodwill and accounted for in the same manner as goodwill.

SFAS No. 142 was affective for fiscal years beginning after December 15, 2001. Upon adoption of this statement on January 1, 2002, the Company recorded

an impairment loss of $208.2 million, which was supported by an independent valuation of the Company. The impairment loss was recorded as the

cumulative effect of a change in accounting principle.

(l) Advertising Costs

The Company expenses the costs of advertising as incurred. Advertising expense for the years ended December 31, 2004, 2003 and 2002 was $8.3 million,

$9.0 million and $10.6 million, respectively.

(m) Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss

and tax credit carryforwards. A valuation allowance is established, if necessary, for the amount of any tax benefits that, based on available evidence, are not

expected to be realized.

(n) Stock Options

At December 31, 2004, the Company had two stock-based employee compensation plans, which are described more fully in Note 9, "Stock Options and

Awards." The Company accounts for its stock option plans in accordance with the provisions of APB Opinion No. 25, "Accounting for Stock Issued to

Employees," and related interpretations. As such, compensation expense would be recorded on the date of grant only if the current market price of the

underlying stock exceeded the exercise price. Accordingly, no compensation cost has been recognized for stock options in the consolidated financial

statements. Had the Company determined compensation cost based on the fair value at the grant date for its stock options under SFAS No. 123, "Accounting

for Share-Based Payment," the Company's net income (loss) and earnings (loss) per share would have been reduced to the pro forma amounts indicated

below:

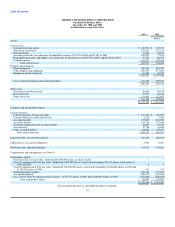

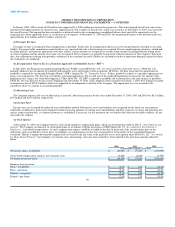

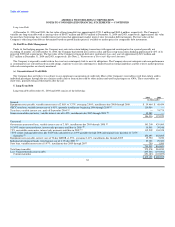

2004 2003 2002

(in thousands except per share data)

Net income (loss), as reported $ (89,023) $ 57,420 $ (387,909)

Stock-based compensation expense, net of income taxes (5,874) (4,320) (3,709)

Pro forma net income (loss) $ (94,897) $ 53,100 $ (391,618)

Earnings (loss) per share:

Basic - as reported $ (2.47) $ 1.66 $ (11.50)

Basic - pro forma $ (2.63) $ 1.54 $ (11.61)

Diluted - as reported $ (2.47) $ 1.26 $ (11.50)

Diluted – pro forma $ (2.63) $ 1.19 $ (11.61)

49