US Airways 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

22 years and 30 years, respectively. The estimated useful lives of our ground property and equipment range from three to 12 years. We test for

impairment losses on long-lived assets used in operations when events and circumstances indicate that the assets might be impaired as defined by

SFAS No. 144, "Accounting for the Impairment or Disposal of Long-Lived Assets." An impairment loss is recognized if the carrying amount of the

asset is not recoverable from its undiscounted cash flows and is measured as the difference between the carrying amount and fair value of the asset.

• Frequent Flyer Accounting – We maintain a frequent travel award program known as "FlightFund" that provides a variety of awards to program

members based on accumulated mileage. The estimated cost of providing the free travel is recognized as a liability and charged to operations as

program members accumulate mileage. Travel awards are valued at the incremental cost of carrying one passenger, based on expected redemptions.

Incremental costs are based on expectations of expenses to be incurred on a per passenger basis and include fuel, liability insurance, food, beverages,

supplies and ticketing costs. We also sell mileage credits to companies participating in our FlightFund program, such as hotels, car rental agencies

and credit card companies. Transportation-related revenue from the sale of mileage credits is deferred and recognized when transportation is

provided. A change to the estimated cost per mile, minimum award level, percentage of revenue to be deferred or deferred recognition period could

have a significant impact on our revenues or mileage liability accrual in the year of the change as well as future years.

• Long-Term Maintenance Reserve – We record an accrual for the estimated cost of scheduled airframe and engine overhauls required to be

performed on leased aircraft upon their return to the lessors. These estimates are based on historical costs and our assumptions regarding the renewal

of aircraft leases. A significant change to AWA's fleet plan could have a material impact on our reserve requirements.

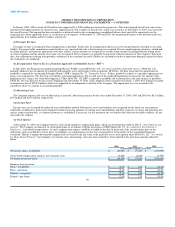

• Deferred Tax Asset Valuation Allowance – The Company initially recorded a full valuation allowance relating to its net deferred tax assets at

December 31, 2001 and to tax benefits generated in 2002. In recording that valuation allowance, we considered whether it was more likely than not

that all or a portion of the deferred tax assets will not be realized, in accordance with SFAS No. 109, "Accounting for Income Taxes." The Company

was in a cumulative loss position three out of four years between December 31, 2001 through December 31, 2004, which weighed heavily in the

overall determination that a valuation allowance was needed. As of December 31, 2004, the Company had recorded a valuation allowance of

$129.0 million against its net deferred tax assets. The Company expects to continue to record a full valuation allowance on any future tax benefits

until we have achieved several quarters of consecutive profitable results coupled with an expectation of continued profitability.

Recently Issued Accounting Pronouncements

In November 2004, the Emerging Issues Task Force ("EITF") of the FASB reached a consensus on EITF 04-08, "The Effect of Contingently Convertible

Instruments on Diluted Earnings per Share," which requires that issuers of convertible securities with contingent conversion features use the "if-converted"

method to calculate reported earnings per share ("EPS") irrespective of the contingent conversion trigger being met. As approved by the FASB, this change is

effective for years ending after December 15, 2004. The Company applied this methodology in the accompanying consolidated statement of operations. The

impact of using the "if-converted" method for the Company's 7.25% Notes is antidilutive for the years ended December 31, 2004 and 2002. For the year

ended December 31, 2003, the inclusion of the 7.25% Notes reduced diluted EPS by $0.03 from $1.29 to $1.26.

In November 2004, the FASB issued Revised Statement No. 123, "Accounting for Share-Based Payment" ("SFAS No. 123R"). This statement requires the

Company to recognize the grant-date fair value of stock options in the Statement of Operations. In addition, the Company will be required to calculate this

compensation using the fair-value based method, versus the intrinsic value method previously allowed under SFAS No. 123. This revision is effective for

periods beginning after June 15, 2005. Accordingly, the Company will adopt this revised SFAS effective July 1, 2005. The Company is currently evaluating

how it will adopt SFAS No. 123R and has not determined the method it will use to value granted stock options. The adoption of SFAS No. 123R is expected

to have a material effect on the Company's results of operations. See Note 1, "Summary of Significant Accounting Policies" (m) "Stock Options" for the

Company's disclosure of the impact of the compensation cost associated with stock options under SFAS No. 123.

39