US Airways 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AMERICA WEST HOLDINGS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

Holders of common stock of all classes participate equally as to any dividends or distributions on the common stock, except that dividends payable in

shares of common stock, or securities to acquire common stock, will be made in the same class of common stock as that held by the recipient of the dividend.

Holders of common stock have no right to cumulate their votes in the election of directors. The common stock votes together as a single class, subject to the

right to a separate class vote in certain instances required by law.

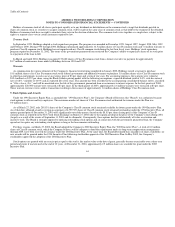

Treasury Stock

In September 1995, Holdings adopted a stock repurchase program. The program was amended in December 1995, August 1997, August 1998, May 1999

and February 2000. During 1995 through 2000, Holdings repurchased approximately 16.5 million shares of Class B common stock and 7.4 million warrants to

purchase Class B common stock. Holdings has not repurchased any Class B common stock during the last four fiscal years. Holdings' stock repurchase

program expired on December 31, 2002. The terms of the government guaranteed loan restricted the Company's ability to repurchase shares of its stock prior

to repayment of the loan in full.

In March and April 2004, Holdings reacquired 153,680 shares of Class B common stock from a former executive in payment for approximately

$1.7 million of nonrecourse loans made by Holdings between 1994 and 1997.

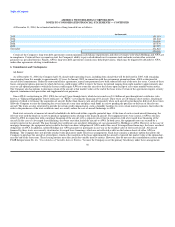

Warrants

As compensation for various elements of the Company's financial restructuring completed in January 2002, Holdings issued a warrant to purchase

18.8 million shares of its Class B common stock to the federal government and additional warrants to purchase 3.8 million shares of its Class B common stock

to other loan participants, in each case at an exercise price of $3 per share and a term of ten years. For accounting purposes, the warrants were valued at

$35.4 million, or $1.57 per share, using the Black-Scholes pricing model with the following assumptions: expected dividend yield of 0.0%, risk-free interest

rate of 4.8%, volatility of 44.9% and an expected life of ten years. This amount has been recorded in the accompanying consolidated balance sheets, classified

as "Other Assets, Net," and will be amortized over the life of the government guaranteed loan as an increase to interest expense. In the first quarter of 2004,

approximately 220,000 warrant were exercised at $3 per share. In the third quarter of 2003, approximately 2.6 million warrants were exercised at $3 per share.

These warrant exercises were cashless transactions resulting in the issuance of approximately 1.6 million shares of Holdings' Class B common stock.

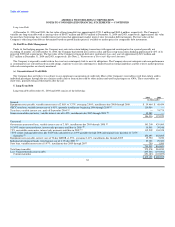

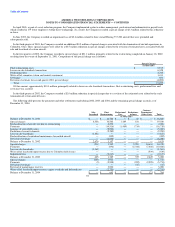

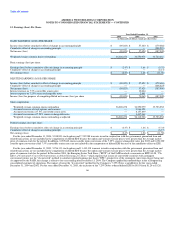

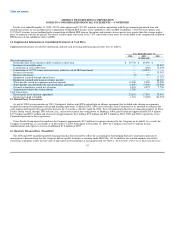

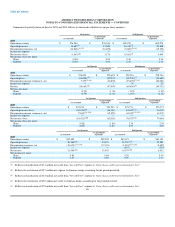

9. Stock Options and Awards

Under the 1994 Incentive Equity Plan, as amended (the "1994 Incentive Plan"), the Company's Board of Directors (the "Board") was authorized to grant

stock options to officers and key employees. The maximum number of shares of Class B common stock authorized for issuance under the Plan was

9.0 million shares.

As of March 27, 2002, only 205,831 shares of the Company's Class B common stock remained available for future grants under the 1994 Incentive Plan.

As of that date, although awards covering an aggregate of 6,799,570 shares of Class B common stock remained outstanding under the 1994 Incentive Plan, all

options granted prior to December 31, 2001 were significantly out-of-the-money (based on the $5.55 per share closing price of the Company's Class B

common stock as reported on the New York Stock Exchange on March 27, 2002) due to the significant drop in the price of the Company's stock during 2001

(largely as a result of the events of September 11, 2001 and its aftermath). Consequently, these options had lost substantially all value as retention and

incentive tools. The Board is strongly opposed to repricing outstanding stock options and, in connection with the government guaranteed loan, the Company

agreed not to reprice any outstanding stock options so long as the loan remains outstanding.

For these reasons, on March 27, 2002, the Board adopted the Company's 2002 Incentive Equity Plan (the "2002 Incentive Plan"). A total of 8.0 million

shares of Class B common stock, which the Company believes will be adequate to fund the requirements under its long-term compensation arrangements

through 2005, have been reserved for issuance under the 2002 Incentive Plan. At the same time, the Board determined that, regardless of share availability, no

new awards will be granted under the 1994 Incentive Plan following stockholder approval of the 2002 Incentive Plan. In May 2002, the Company's

stockholders approved the adoption of the 2002 Incentive Plan.

Stock options are granted with an exercise price equal to the stock's fair market value at the date of grant, generally become exercisable over a three-year

period and expire if unexercised at the end of 10 years. At December 31, 2004, approximately 2.5 million shares are available for grant under the 2002

Incentive Plan.

61