US Airways 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

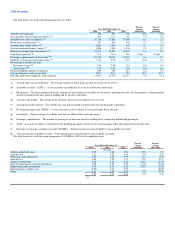

In 2004, net cash used in investing activities was $16.1 million for Holdings and $16.0 for AWA, respectively. This compares to net cash used in investing

activities of $491.6 million for both Holdings and AWA in 2003. Principal investing activities during 2004 included purchases of property and equipment

totaling $219.4 million for both Holdings and AWA and net sales of short-term investments and investments in debt securities totaling $205.3 million for both

Holdings and AWA. The 2003 period included purchases of property and equipment totaling $154.4 million for both Holdings and AWA and net purchases of

short-term investments totaling $269.4 million for both Holdings and AWA. Restricted cash increased by $2.2 million during 2004 compared to an increase of

$23.9 million during 2003 primarily due to an increase in cash reserves required under an agreement for processing the Company's Visa and MasterCard

credit card transactions. The 2003 period also included proceeds from the disposition of assets totaling $25.8 million.

In 2004, net cash used in financing activities was $41.2 million and $42.3 million for Holdings and AWA, respectively, consisting principally of $175.6

debt repayments including principal repayments of $85.8 million for the government guaranteed loan. In addition, AWA entered into a term loan financing

with GECC resulting in proceeds of $110.6 million, approximately $77.0 million of which was used to pay off the balance of the term loan with Muzuho

Corporate Bank, Ltd. and certain other lenders. The 2004 period also includes $30.8 million of proceeds from the issuance of senior secured discount notes,

secured by the Company's leasehold interest in its Phoenix maintenance facility and flight training center. This compares to net cash provided by financing

activities of $67.4 million and $65.0 million for Holdings and AWA, respectively, in 2003. The 2003 period included proceeds from the issuance of senior

exchangeable notes totaling $86.8 million and debt repayments of $16.8 million.

Capital expenditures for 2004 were $219.4 million for Holdings and AWA. Capital expenditures for 2003 were $154.4 million for Holdings and AWA.

Included in these amounts are capital expenditures for capitalized maintenance of approximately $139.2 million and $119.3 million for both Holdings and

AWA for 2004 and 2003, respectively.

Off-Balance Sheet Arrangements

The Pass Through Trusts

Since AWA's restructuring in 1994, AWA has set up 19 pass through trusts, which have issued over $1.4 billion of pass through trust certificates (also

known as "Enhanced Equipment Trust Certificates" or "EETC") covering the financing of 54 aircraft. These trusts are off-balance sheet entities, the primary

purpose of which is to finance the acquisition of aircraft. Rather than finance each aircraft separately when such aircraft is purchased or delivered, these trusts

allow the Company to raise the financing for several aircraft at one time and place such funds in escrow pending the purchase or delivery of the relevant

aircraft. The trusts are also structured to provide for certain credit enhancements, such as liquidity facilities to cover certain interest payments, that reduce the

risks to the purchasers of the trust certificates and, as a result, reduce the cost of aircraft financing to AWA.

Each trust covered a set amount of aircraft scheduled to be delivered within a specific period of time. At the time of each covered aircraft financing, the

relevant trust used the funds in escrow to purchase equipment notes relating to the financed aircraft. The equipment notes were issued, at AWA's election,

either by AWA in connection with a mortgage financing of the aircraft or by a separate owner trust in connection with a leveraged lease financing of the

aircraft. In the case of a leveraged lease financing, the owner trust then leased the aircraft to AWA. In both cases, the equipment notes are secured by a

security interest in the aircraft. The pass through trust certificates are not direct obligations of, nor guaranteed by, Holdings or AWA. However, in the case of

mortgage financings, the equipment notes issued to the trusts are direct obligations of AWA and in the case of leveraged lease financings, the leases are direct

obligations of AWA. In addition, neither Holdings nor AWA guarantee or participate in any way in the residual value of the leased aircraft. All aircraft

financed by these trusts are currently structured as leveraged lease financings, which are not reflected as debt on the balance sheets of either AWA or

Holdings. In 2004, AWA made $168.5 million in lease payments in respect of the leveraged lease financings under the pass through trusts.

Other Operating Leases

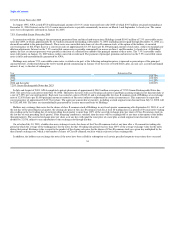

In addition to the aircraft financed by the pass through trust certificates, AWA has noncancelable operating leases covering 82 aircraft, of which four

aircraft will be delivered in 2005, as well as leases for certain terminal space, ground facilities and computer and other equipment. In 2004, AWA made

$197.2 million in lease payments related to these operating leases. See the Airline's fleet section in Item 1 for further discussion.

31