US Airways 2004 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AMERICA WEST AIRLINES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

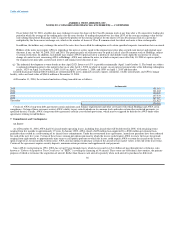

not needed when there is negative evidence such as cumulative losses in recent years. Therefore, cumulative losses weigh heavily in the overall assessment.

AWA was in a cumulative loss position three out of four years between December 31, 2001 through December 31, 2004, which weighed heavily in the

overall determination that a valuation allowance was needed. As of December 31, 2004, AWA had recorded a valuation allowance of $127.5 million against

its net deferred tax assets. AWA expects to continue to record a full valuation allowance on any future tax benefits until we have achieved several quarters of

consecutive profitable results coupled with an expectation of continued profitability. As of December 2004 and 2003, the valuation allowance totaled

$127.5 million and $96.4 million, respectively.

9. Capital Stock

Common Stock

The holders of common stock are entitled to one vote for each share of stock held by the holder. Holders of common stock have no right to cumulate their

votes in the election of directors. The holders of common stock are entitled to receive, when and if declared by the Board of Directors, out of the assets of

AWA which are by law available, dividends payable either in cash, in stock or otherwise.

Warrants

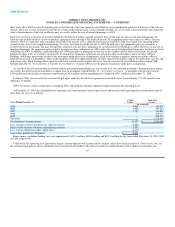

As compensation for various elements of AWA's financial restructuring completed in January 2002, Holdings issued a warrant to purchase 18.8 million

shares of its Class B common stock to the federal government and additional warrants to purchase 3.8 million shares of its Class B common stock to other

loan participants, in each case at an exercise price of $3 per share and a term of ten years. For accounting purposes, the warrants were valued at $35.4 million,

or $1.57 per share, using the Black-Scholes pricing model with the following assumptions: expected dividend yield of 0.0%, risk-free interest rate of 4.8%,

volatility of 44.9% and an expected life of ten years. The warrants were recorded by AWA as a non-cash capital contribution in the accompanying

consolidated statements of stockholder's equity and comprehensive income and classified as "Other Assets, Net" in the accompanying consolidate balance

sheets. The warrants will be amortized over the life of the government guaranteed loan as an increase to interest expense. In the first quarter of 2004,

approximately 220,000 warrants were exercised at $3 per share. In the third quarter of 2003, approximately 2.6 million warrants were exercised at $3 per

share. These warrant exercises were cashless transactions resulting in the issuance of approximately 1.6 million shares of Holdings' Class B common stock.

10. Employee Benefit Plan

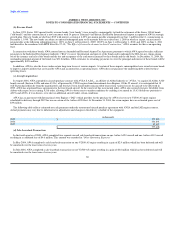

Holdings has a 401(k) defined contribution plan, covering essentially all employees of AWA. Participants may contribute from 1 to 50% of their pretax

earnings to a maximum of $13,000 in 2004. AWA's matching contribution is determined annually by the Board of Directors. AWA's contribution expense to

the plan totaled $11.4 million, $8.6 million and $8.6 million in 2004, 2003 and 2002, respectively.

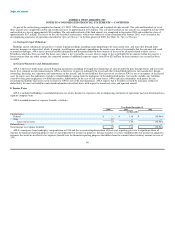

During the third quarter of 2004, Holdings became aware that an insufficient number of shares of its Class B common stock were registered for offer and

sale through its 401(k) plan. In response to this registration shortfall, Holdings promptly filed a new registration statement on Form S-8 on August 13, 2004,

which registered an additional 4,500,000 shares of Class B common stock to permit the continued offer and sale of such shares to participants through the

401(k) plan. Because the 401(k) plan in the past has purchased and in the future expects to continue to purchase shares of Class B common stock needed for

allocation to participant accounts only in the open market and not directly from Holdings, the registration of these additional shares and their purchase by the

401(k) plan will have no dilutive impact on the outstanding equity of Holdings. As a result of the registration shortfall, however, participants who acquired

unregistered shares through their 401(k) plan accounts after June 30, 2003, and prior to August 13, 2004, may be entitled to rescission rights or other remedies

under the Securities Act of 1933, as amended. Holdings has notified affected existing and former plan participants of their potential rescission rights, but

cannot predict the extent to which any such rescission rights may be exercised or the impact of any possible federal or state regulatory action pertaining to the

registration shortfall. Holdings does not believe, however, that any consequences arising from the registration shortfall will have a material adverse effect on

its financial position or results of operations.

91