US Airways 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AMERICA WEST HOLDINGS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

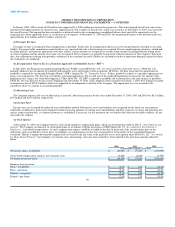

(o) New Accounting Standards

In November 2004, the Emerging Issues Task Force ("EITF") of the FASB reached a consensus on EITF 04-08, "The Effect of Contingently Convertible

Instruments on Diluted Earnings per Share," which requires that issuers of convertible securities with contingent conversion features use the "if-converted"

method to calculate reported earnings per share ("EPS") irrespective of the contingent conversion trigger being met. As approved by the FASB, this change is

effective for years ending after December 15, 2004. The Company applied this methodology in the accompanying consolidated statement of operations. The

impact of using the "if-converted" method for the Company's 7.25% Notes is antidilutive for the years ended December 31, 2004 and 2002. For the year

ended December 31, 2003, the inclusion of the 7.25% Notes reduced diluted EPS by $0.03 from $1.29 to $1.26.

In November 2004, the FASB issued Revised Statement No. 123, "Accounting for Share-Based Payment" ("SFAS No. 123R"). This statement requires the

Company to recognize the grant-date fair value of stock options in the Statement of Operations. In addition, the Company will be required to calculate this

compensation using the fair-value based method, versus the intrinsic value method previously allowed under SFAS No. 123. This revision is effective for

periods beginning after June 15, 2005. Accordingly, the Company will adopt this revised SFAS effective July 1, 2005. The Company is currently evaluating

how it will adopt SFAS No. 123R and has not determined the method it will use to value granted stock options. The adoption of SFAS No. 123R is expected

to have a material effect on the Company's results of operations. See Note 1, "Summary of Significant Accounting Policies" (m) "Stock Options" for the

Company's disclosure of the impact of the compensation cost associated with stock options under SFAS No. 123.

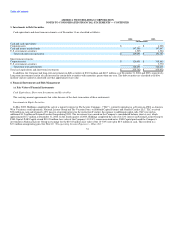

(p) Use of Estimates

Management of the Company has made certain estimates and assumptions relating to the reporting of assets and liabilities and the disclosure of contingent

assets and liabilities to prepare these consolidated financial statements in conformity with accounting principles generally accepted in the United States.

Actual results could differ from those estimates.

(q) Reclassifications

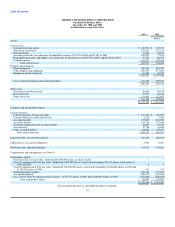

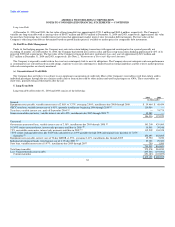

The Company reclassified amounts related to settled fuel hedge transactions and mark-to-market adjustments on open hedge instruments from "Aircraft

Fuel" expense to "Gain (Loss) on Derivative Instruments, Net" in the accompanying consolidated statement of operations. In fiscal years 2004 and 2003, such

amounts reduced fuel expense while in fiscal years 2002 and 2001, such amounts increased fuel expense, as originally classified. The amounts reclassified are

as follows:

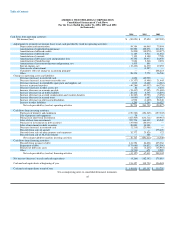

Fiscal Year Amounts Reclassified

(in thousands)

2004 $ 30,529

2003 10,746

2002 (656)

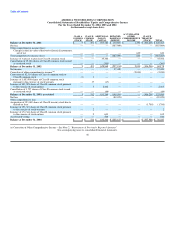

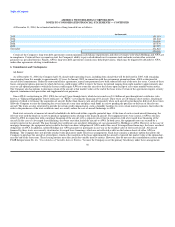

2. Restatement of Previously Reported Amounts

Derivative Instruments

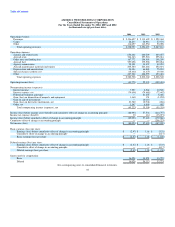

In February 2005, management undertook a review of the Company's accounting for its fuel hedging transactions. As a result of this review, management

concluded that the Company's fuel hedging transactions did not qualify for hedge accounting under U.S. generally accepted accounting principles.

Accordingly, management concluded that the financial statements for prior periods required restatement to reflect the fair value of fuel hedging contracts in

the balance sheets and statements of stockholders equity and comprehensive income of Holdings and AWA. Specifically, (i) Holdings has restated its balance

sheet and statement of stockholders' equity and comprehensive income as of and for the year ended December 31, 2003, and (ii) AWA has restated its balance

sheet and statement of stockholder's equity and comprehensive income as of and for the year ended December 31, 2003, and (iii) Holdings and AWA have

restated their 2004 and 2003 interim financial results to correct the aforementioned accounting errors. The unaudited interim results as originally reported and

as restated are presented in Note 16, "Quarterly Financial Data (Unaudited)." The Company restated its 2003 consolidated balance sheet to reduce the

carrying value of its derivative instruments asset by $12.5 million, which served to record the asset at fair value of open contracts as of December 31, 2003.

The restatement also eliminated $12.5 million in accumulated other comprehensive income, $2.0 million of which was previously recorded in the 2003

beginning balance of accumulated other comprehensive income. The restated amount of other assets is $112 million in the accompanying 2003 consolidated

balance sheet. The restatement eliminates the balance in accumulated other comprehensive income in the accompanying 2003 consolidated balance sheet and

consolidated statement of stockholders' equity and comprehensive income.

50