US Airways 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

AMERICA WEST HOLDINGS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — CONTINUED

obligations outstanding under the government guaranteed loan and has pledged the stock of AWA to secure its obligations under such guarantee.

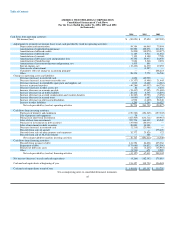

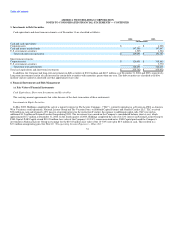

Principal amounts under this loan become due in ten installments of $42.9 million on each March 31 and September 30, commencing on March 31,

2004 and ending on September 30, 2008. Principal amounts outstanding under the government guaranteed loan bear interest at a rate per annum equal

to LIBOR plus 40 basis points.

Subject to certain exceptions, AWA is required to prepay the government guaranteed loan with:

• the net proceeds of all issuances of debt or equity by either Holdings or AWA after January 2002;

• proceeds from asset sales in excess of $20 million in any fiscal year; and

• insurance proceeds in excess of $2 million to the extent such proceeds are not used to restore or replace the assets from which such proceeds are

derived.

In addition, AWA is required to prepay the government guaranteed loan upon a change in control and we may be required to prepay portions of the loan

if our employee compensation costs exceed a certain threshold. AWA may, at its option, prepay the government guaranteed loan without premium or

penalty, subject to reimbursement of the lenders' breakage costs in the case of prepayment of LIBOR loans.

The government guaranteed loan requires that AWA maintain a minimum cash balance of $100 million. In addition, the government loan contains

customary affirmative covenants and the following negative covenants: restrictions on liens, investments, restricted payments, fundamental changes,

asset sales and acquisitions, the creation of new subsidiaries, sale and leasebacks, transactions with affiliates, the conduct of business, mergers or

consolidations, issuances and dispositions of capital stock of subsidiaries, and amendments to other indebtedness. The government guaranteed loan

contains customary events of default, including payment defaults, cross-defaults, breach of covenants, bankruptcy and insolvency defaults and

judgment defaults.

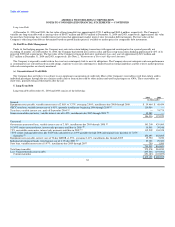

(d) In August 1995, AWA issued $75.0 million principal amount of 10 3/4% senior unsecured notes due 2005 of which $39.5 million remained outstanding

at December 31, 2004. Interest on the 10 3/4% senior unsecured notes is payable semiannually in arrears on March 1 and September 1 of each year. On

December 27, 2004, AWA called for the redemption on January 26, 2005 of all of the senior unsecured notes at a redemption price of 100% of the

principal amount thereof plus accrued and unpaid interest through the redemption date. In addition, AWA irrevocably deposited the $30.8 million raised

through the maintenance facility and flight training center financing, together with an additional $10.5 million from its operating cash flow, with the

trustee for the senior unsecured notes. The senior notes were subsequently redeemed on January 26, 2005.

(e) In connection with the closing of the government guaranteed loan and the related transactions, Holdings issued $104.5 million of 7.5% convertible

senior notes due 2009, of which approximately $112.3 million remained outstanding at December 31, 2004 (including $21.6 million of interest paid

through December 31, 2004 as a deemed loan added to the initial principal thereof). Beginning January 18, 2005, these notes are convertible into shares

of class B common stock, at the option of the holders, at an initial conversion price of $12.00 per share or a conversion ratio of approximately 83.333

shares per $1,000 principal amount of such notes, subject to standard anti-dilution adjustments. Interest on the 7.5% convertible senior notes is payable

semiannually in arrears on June 1 and December 1 of each year. At Holdings' option, the first six interest payments were payable in the form of a

deemed loan added to the principal amount of these notes. The 7.5% convertible senior notes will mature on January 18, 2009 unless earlier converted

or redeemed. The payment of principal, premium and interest on the 7.5% convertible senior notes is fully and unconditionally guaranteed by AWA.

Holdings may redeem some or all of the 7.5% convertible senior notes at any time before January 18, 2005, at a redemption price equal to $1,000 per

note to be redeemed if (A) the closing price of the class B common stock has exceeded 120% of the conversion price then in effect for at least 20

trading days within a period of 30 consecutive trading days ending on the trading day before the date of the mailing of the redemption notice, and (B) a

shelf registration statement covering resales of the notes and the class B common stock issuable upon conversion thereof is effective and available for

use and is expected to remain effective and available for use for the 30 days following the redemption date, unless registration is no longer required.

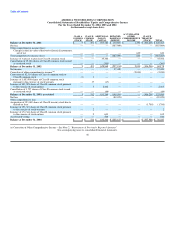

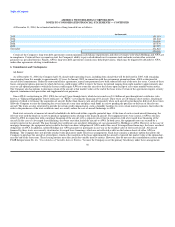

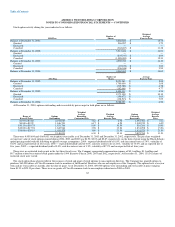

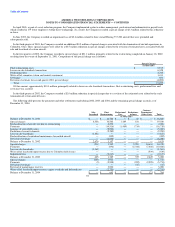

Holdings may redeem the 7.5% convertible senior notes, in whole or in part, on or after January 18, 2005 at the following redemption prices (expressed

as percentages of the principal amount thereof), if redeemed during the twelve-month period commencing on January 18 of the years set forth below,

plus, in each case, accrued and unpaid interest, if any, to the date of redemption:

54