US Airways 2004 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346

|

|

Table of Contents

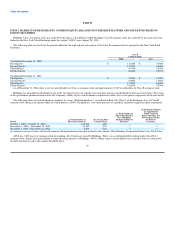

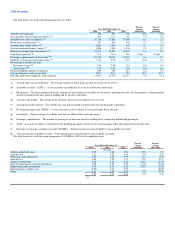

(c) Nonoperating income (expense) in the 2004 period includes a $30.5 million net gain on derivative instruments, which included mark-to-market changes

and settled transactions, and $1.3 million for the write-off of debt issue costs in connection with the refinancing of the term loan. The 2003 period

includes federal government assistance of $81.3 million recognized as nonoperating income under the Emergency Wartime Supplemental

Appropriations Act and $8.5 million and $108.2 million recognized in 2002 and 2001, respectively, as nonoperating income under the Air

Transportation Safety and System Stabilization Act. The 2003, 2002 and 2001 periods include a $10.7 million net gain, $0.7 million net loss and

$7.2 million net loss on derivative instruments, respectively, including mark-to-market changes and settled transactions. See Note 12, "Nonoperating

Income (Expenses) — Other, Net" in Holdings' Notes to Consolidated Financial Statements.

(d) The Company recalculated its diluted EPS for the year ended December 31, 2003 to include the 7.25% notes under the "if-converted" methodology.

The impact reduced diluted EPS by $0.03 from $1.29 to $1.26.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Holdings' primary business activity is ownership of the capital stock of AWA and, prior to January 1, 2004, The Leisure Company. Management's

Discussion and Analysis of Financial Condition and Results of Operations presented below relates to the consolidated financial statements of Holdings

presented in Item 8A and the consolidated financial statements for AWA presented in Item 8B.

Restatement of Previously Reported Amounts

Derivative Instruments

In February 2005, management undertook a review of AWA's accounting for its fuel hedging transactions. As a result of this review, management

concluded that AWA's fuel hedging transactions did not qualify for hedge accounting under U.S. generally accepted accounting principles and that the

Company's financial statements for prior periods required restatement to reflect the fair value of fuel hedging contracts in the balance sheets and statements of

stockholders equity and comprehensive income of Holdings and AWA. See Note 2, "Restatement of Previously Reported Amounts" and Note 16, "Quarterly

Financial Data (Unaudited)" in Holdings' and Note 2, "Restatement of Previously Reported Amounts" and Note 15, "Quarterly Financial Data (Unaudited)"

in AWA's consolidated financial statements for the financial impact of the restatements. The Company concluded that these accounting errors were the result

of deficiencies in its internal control over financial reporting, from the lack of effective reviews of hedge transaction documentation and of quarterly mark-to-

market accounting entries on open fuel hedging contracts by personnel at an appropriate level.

2004 in Review

Overview

Over the past several years, the U.S. domestic airline industry has experienced an unprecedented financial crisis caused by the combination of the terrorist

attacks of September 11, 2001, soft economic conditions, increased competition and capacity and high fuel prices. In response to these conditions, AWA had

repositioned itself as a low cost carrier and was able to operate profitably for 2003. During 2004, however, extremely high jet fuel prices and excessive

capacity throughout the domestic air system began to negatively impact all airlines including the low cost segment of the airline industry as well and several

low cost carriers that had previously operated profitably, including AWA, experienced declining earnings. Despite difficult industry conditions, AWA was

able to complete two financial transactions in the third and fourth quarters of 2004 that brought additional capital into the company and extended debt

maturities.

During 2004, our constant commitment to lower costs remained a priority and we implemented the following revenue and cost reduction initiatives:

22