US Airways 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

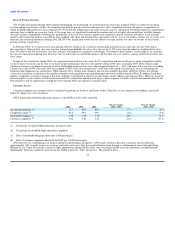

reportable delays significantly outpaced the growth of domestic air traffic. For the year, FAA reportable delays grew 41.1% year-over-year compared to a

4.5% growth in domestic air traffic. AWA's utilization growth, coupled with the increased ATC delays, offset somewhat by operating improvements, were the

contributing factors resulting in the overall change in operating performance.

2005 Outlook

We continue to face considerable challenges in 2005, including competing with legacy carriers that, through a variety of restructuring mechanisms, have

reduced labor wages, extended debt maturities and lowered their overall cost per available seat mile. These actions could cause AWA's cost advantage to

diminish. In addition, recent fare initiatives by the major carriers may also cause a reduction in revenue per available seat mile. In 2004, we made loan

repayments of approximately $85.8 million on the government guaranteed loan and payments of approximately $168.5 million in respect to our off-balance

sheet aircraft financing arrangements. In 2005, we will need to make loan repayments of approximately $85.8 million on the government guaranteed loan,

$41.3 million to redeem the 10 3/4 senior unsecured notes and payments of approximately $167.8 million in respect to our off-balance sheet aircraft financing

arrangements. Although there can be no assurances, management believes that cash flow from operating activities, coupled with existing cash balances and

financing commitments, will be adequate to fund the Company's operating and capital needs as well as enable it to maintain compliance with its various debt

agreements at least through December 31, 2005. See "Risk Factors Relating to the Company and Industry Related Risks" and "Management's Discussion and

Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources."

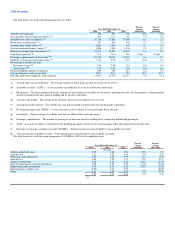

Results of Operations

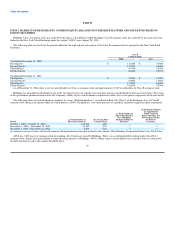

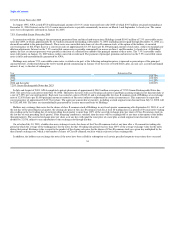

Summary of Holdings' Financial Results

Holdings recorded a consolidated net loss of $89.0 million in 2004, or diluted earnings per share of $2.47. This compares to consolidated income of

$57.4 million, or $1.26 per diluted share, in 2003 and a consolidated loss before the cumulative effect of a change in accounting principle of $179.7 million,

or $5.33 per diluted share, in 2002. Including the cumulative effect of a change in accounting principle related to the Company's adoption of Statement of

Financial Accounting Standards ("SFAS") No. 142, "Goodwill and Other Intangible Assets," on January 1, 2002, Holdings' net loss for 2002 was

$387.9 million, or $11.50 per diluted share.

The 2004 results include a $16.3 million net credit associated with the termination of the rate per engine hour agreement with General Electric Engine

Services for overhaul maintenance services on V2500-A1 engines. This credit was partially offset by $1.9 million of net charges related to the return of

certain Boeing 737-200 aircraft which includes termination payments of $2.1 million, the write-down of leasehold improvements and deferred rent of

$2.8 million, offset by the net reversal of maintenance reserves of $3.0 million.

The 2004 results also include a $30.5 million net gain on derivative instruments, including mark-to-market changes and settled transactions, a $6.1 million

charge arising from the resolution of pending litigation, a $4.6 million loss on the sale and leaseback of two new Airbus aircraft and a $1.3 million charge for

the write-off of debt issue costs in connection with the refinancing of the term loan.

The 2003 results include a nonoperating gain of $81.3 million related to the federal government assistance received under the Emergency Wartime

Supplemental Appropriations Act, a $10.8 million net gain on derivative instruments, including mark-to-market changes and settled transactions, a

$9.8 million nonoperating gain on sale of the Company's investment in Hotwire.com and a $3.3 million nonoperating gain on sale of the Company's

investment in National Leisure Group. See Note 12, "Nonoperating Income (Expenses) – Other, Net" in Holdings' Notes to Consolidated Financial

Statements. The 2003 results also include an operating gain of $4.4 million related to the purchase and subsequent exchange of an A320 airframe and a

$2.8 million operating gain related to the settlement of disputed billings under the Company's frequent flyer program. These gains were offset in part by

$19.7 million of charges related to the execution of a new labor agreement with the Air Line Pilots Association ("ALPA") net charges of $14.4 million

resulted from the elimination of AWA's hub operations in Columbus, Ohio ($11.1 million), the reduction-in-force of certain management, professional and

administrative employees ($2.3 million) and the impairment of certain owned Boeing 737-200 aircraft that have been grounded ($2.6 million), offset by a $1.1

million reduction due to a revision of the estimated costs related to the early termination of certain aircraft leases and a $0.5 million reduction related to the

revision of estimated costs associated with the sale and leaseback of certain aircraft. See Note 11, "Special Charges" in Holdings' Notes to Consolidated

Financial Statements.

25