US Airways 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

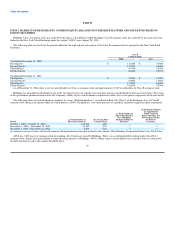

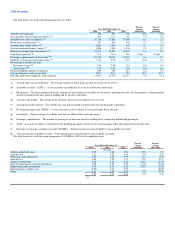

ITEM 6. SELECTED CONSOLIDATED FINANCIAL DATA

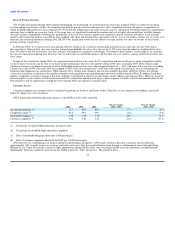

Selected Consolidated Financial Data of Holdings

The selected consolidated financial data presented below under the captions "Consolidated Statements of Operations Data" and "Consolidated Balance

Sheet Data" as of and for the years ended December 31, 2004, 2003, 2002, 2001 and 2000 are derived from the audited consolidated financial statements of

Holdings. The selected consolidated financial data should be read in conjunction with the consolidated financial statements for the respective periods, the

related notes and the related reports of the Company's independent registered public accounting firms.

Year ended December 31,

2004 2003 2002 2001 2000

(in thousands except per share amounts)

Consolidated statements of operations data:

Operating revenues $2,338,957 $2,254,497 $2,047,116 $2,065,913 $2,344,354

Operating expenses (b) 2,382,728 2,232,362 2,206,540 2,476,594 2,356,991

Operating income (loss) (43,771) 22,135 (159,424) (410,681) (12,637)

Income (loss) before income taxes (benefit) and cumulative effect of change in accounting

principle (c) (88,993) 57,534 (214,757) (324,387) 24,743

Income taxes (benefit) 30 114 (35,071) (74,536) 17,064

Income (loss) before cumulative effect of change in accounting principle (89,023) 57,420 (179,686) (249,851) 7,679

Net income (loss) (89,023) 57,420 (387,909) (249,851) 7,679

Earnings (loss) per share before cumulative effect of change in accounting principle:

Basic (2.47) 1.66 (5.33) (7.42) 0.22

Diluted (2.47) 1.26 (5.33) (7.42) 0.22

Net income (loss) per share:

Basic (2.47) 1.66 (11.50) (7.42) 0.22

Diluted (d) (2.47) 1.26 (11.50) (7.42) 0.22

Shares used for computation:

Basic 36,026 34,551 33,723 33,670 35,139

Diluted (d) 36,026 56,113 33,723 33,670 35,688

Consolidated balance sheet data (at end of period):

Total assets (a) $1,475,264 $1,614,385 $1,438,953 $1,469,218 $1,568,515

Long-term debt, less current maturities 635,129 688,965 700,983 224,551 145,578

Total stockholders' equity (a) 36,447 125,989 68,178 420,363 667,073

(a) The Company has restated its consolidated balance sheet and consolidated statement of stockholders' equity and comprehensive income as of and for

the year ended December 31, 2003 to reflect the non-compliance with SFAS No. 133. See Note 2, "Restatement of Previously Reported Amounts" in

Notes to Consolidated Financial Statements.

(b) The 2004 results include a $16.3 million net credit associated with the termination of the rate per engine hour agreement with General Electric Engine

Services for overhaul maintenance services on V2500-A1 engines, a $0.6 million credit related to the revision of the estimated costs associated with the

sale and leaseback of certain aircraft recorded in the first quarter of 2002 and a $0.4 million credit related to the revision of estimated charges associated

with the Columbus, Ohio hub ("CMH") closure originally recorded in the second quarter of 2003. These credits were partially offset by $1.9 million of

net charges related to the return of certain Boeing 737-200 aircraft which includes termination payments of $2.1 million, the write-down of leasehold

improvements and deferred rent of $2.8 million, offset by the net reversal of maintenance reserves of $3.0 million. The 2003 period includes

$16.0 million of charges resulting from the elimination of AWA's hub operations in CMH ($11.1 million), the reduction-in-force of certain

management, professional and administrative employees ($2.3 million), the impairment of certain owned Boeing 737-200 aircraft that have been

grounded ($2.6 million) offset by a $1.1 million reduction of charges due to a revision of the estimated costs related to the early termination of certain

aircraft leases and a $0.5 million reduction related to the revision of estimated costs associated with the sale and leaseback of certain aircraft. The 2002

period includes $19.0 million of charges primarily related to the restructuring completed on January 18, 2002, resulting from the events of

September 11, 2001. The 2001 period includes $141.6 million of special charges related to the impairment of reorganization value in excess of amounts

allocable to identifiable assets ("ERV") and owned aircraft and engines, as well as the earlier-than-planned return of seven leased aircraft and severance

expenses following a reduction-in-force in 2001. See Note 11, "Special Charges" in Holdings' Notes to Consolidated Financial Statements. The

Company reclassified amounts related to settled fuel hedge transactions and mark-to-market adjustments on open hedge instruments from fuel expense

to gain (loss) on derivative instruments, net. The amounts for the years ended December 31, 2004 and 2003 were an addition to fuel expense of

$30.5 million and $10.7 million, respectively. For the years ended December 31, 2002 and 2001, the amounts reduced fuel expense by $0.7 million and

$7.2 million, respectively. 21