US Airways 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

passengers through increased fares. In addition, we cannot forecast what new security and safety requirements may be imposed in the future or the costs or

financial impact of complying with any such requirements.

In 1997, new aviation taxes were imposed through September 30, 2007 to provide funding for the FAA. Included in the law is a phase-in of a modified

federal air transportation excise tax structure with a system that includes a domestic excise tax which started at 9% and declined to 7.5% in 1999, a domestic

segment tax that started at $1.00 and increased to $3.00 in 2003, and an increase in taxes imposed on international travel from $6.00 per international

departure to an arrival and departure tax of $12.00 (each way). Both the domestic segment tax and the international arrival and departure tax are indexed for

inflation. The legislation also included a 7.5% excise tax on certain amounts paid to an air carrier for the right to provide mileage and similar awards (e.g.,

purchase of frequent flyer miles by a credit card company). As a result of competitive pressures, AWA and other airlines have been limited in their ability to

pass on the cost of these taxes to passengers through fare increases.

For additional information on government regulation and its effect on the Company see "Government Regulations" in Item 1, Business.

Related Party Transactions

As part of our reorganization in 1994, Continental Airlines and AWA entered into an alliance agreement that included code sharing arrangements,

reciprocal frequent flyer programs and ground handling operations. In March 2002, AWA received notice from Continental of its intention to terminate the

code sharing and frequent flyer agreements between the two airlines, effective April 26, 2002. Two of Continental's directors are managing partners of Texas

Pacific Group, which, through TPG Advisors, Inc., effectively controls the voting power of Holdings. See "Risk Factors Relating to the Company and

Industry Related Risks — The stockholders who effectively control the voting power of Holdings could take actions that would favor their own personal

interests to the detriment of our interests." AWA paid Continental approximately $13.4 million, $17.3 million and $25.5 million and also received

approximately $4.1 million, $5.0 million and $15.9 million in 2004 and 2003 and 2002, respectively, from Continental pursuant to these agreements.

Texas Pacific Group agreed to reimburse the Company approximately $2.5 million for expenses incurred by the Company on its behalf. As a result, the

Company recorded this as a receivable as of December 31, 2004. Subsequent to December 31, 2004, the Company received $1.3 million in such

reimbursement and expects to receive an additional $1.2 million in 2005.

Application of Critical Accounting Policies

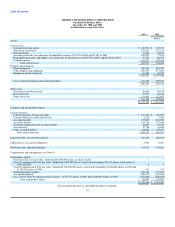

The preparation of our consolidated financial statements in accordance with generally accepted accounting principles requires that we make certain

estimates and assumptions that affect the reported amount of assets and liabilities, revenues and expenses, and the disclosure of contingent assets and

liabilities at the date of our financial statements. We believe our estimates and assumptions are reasonable; however, actual results could differ from those

estimates. We have identified the following critical accounting policies that require the use of significant judgments and estimates relating to matters that are

inherently uncertain and may result in materially different results under different assumptions and conditions.

• Passenger Revenue – Passenger revenue is recognized when transportation is provided. Ticket sales for transportation that has not yet been provided

are recorded as air traffic liability. Passenger traffic commissions and related fees are expensed when the related revenue is recognized. Passenger

traffic commissions and related fees not yet recognized are included as a prepaid expense. Due to complex pricing structures, refund and exchange

policies, and interline agreements with other airlines, certain amounts are recognized in revenue using estimates regarding both the timing of the

revenue recognition and the amount of revenue to be recognized. These estimates are generally based on the statistical analysis of our historical data.

Any adjustments resulting from periodic evaluations of the estimated air traffic liability are included in results of operations during the period in

which the evaluations are completed.

• Accounting For Long-Lived Assets – Owned property and equipment are recorded at cost and depreciated to residual values over the estimated

useful lives using the straight-line method. Leasehold improvements relating to flight equipment and other property on operating leases are

amortized over the life of the lease, or the life of the asset, whichever is shorter. Interest on advance payments for aircraft acquisitions and on

expenditures for aircraft improvements is capitalized and added to the cost of the asset. The estimated useful lives of our owned aircraft, jet engines,

flight equipment and rotable parts range from five to 25 years. The estimated useful lives of our technical support facility and flight training center in

Phoenix, Arizona are 38