US Airways 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 US Airways annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Holders of the notes may require AWA to repurchase the notes at a price equal to the original issue price plus accrued cash interest and original issue

discount, if any, on July 30, 2008, 2013 and 2018. The purchase price of such notes may be paid in cash or class B common stock of Holdings, subject to

certain restrictions. In addition, each holder may require AWA to purchase all or a portion of such holder's notes upon the occurrence of certain change of

control events concerning AWA or Holdings. AWA may redeem the notes, in whole or in part, on or after July 30, 2008 at a price equal to the original issue

price plus accrued cash interest and original issue discount, if any.

Other Indebtedness and Obligations

In addition to the above described indebtedness, we had $39.5 million of secured equipment notes and $45.8 million of other unsecured indebtedness,

including $29.3 million of industrial revenue bonds.

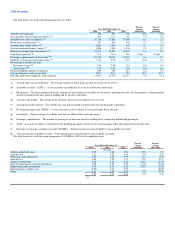

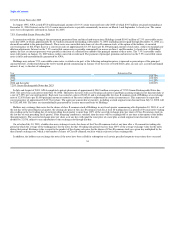

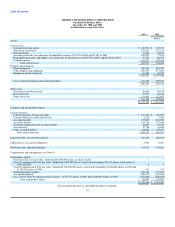

The following table sets forth our cash obligations as of December 31, 2004.

Beyond

2005 2006 2007 2008 2009 2009 Total

(in thousands)

Long-term debt:

Equipment notes – non-EETC (1) $ 8,305 $ 8,305 $ 7,772 $ 15,082 $ — $ — $ 39,464

GECC term loan (2) — 5,158 5,158 5,158 5,158 89,932 110,564

7.5% convertible senior notes due 2009(3) — — — — 112,299 — 112,299

7.25% senior exchangeable notes due 2023 (4) — — — — — 252,695 252,695

Government guaranteed loan (5) 85,800 85,800 85,800 85,800 — — 343,200

State loan (6) 250 250 250 — — — 750

10 3/4% senior unsecured notes due 2005 39,548 — — — — — 39,548

Industrial development bonds (7) — — — — — 29,300 29,300

AVSA promissory notes (8) 15,750 — — — — — 15,750

Senior Secured Discount Notes (9) 1,530 1,529 1,529 1,530 29,870 — 35,988

151,183 101,042 100,509 107,570 147,327 371,927 979,558

Cash aircraft rental payments (10) 343,554 318,668 300,247 249,000 223,894 1,668,015 3,103,378

Lease payments on equipment and facility operating leases (11) 18,117 16,744 14,645 15,017 14,180 51,919 130,622

Capital lease obligations 4,659 4,988 1,773 — — — 11,420

Special facility revenue bonds (12) 1,363 1,363 1,362 1,362 2,044 36,106 43,600

Aircraft purchase commitments (13) 272,820 456,891 47,697 — — — 777,408

Engine maintenance commitments (14) 12,000 6,000 3,000 1,000 — — 22,000

Total $ 803,696 $ 905,696 $ 469,233 $ 373,949 $ 387,445 $ 2,127,967 $ 5,067,986

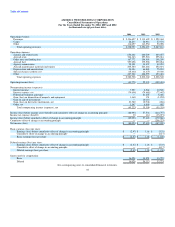

(1)

Includes approximately $39.5 million of equipment notes with variable interest rates of 2.88% to 3.37%, averaging 2.96% at December 31, 2004,

installments due 2005 through 2008.

(2)

The amount consists of two the Spare Parts Facility and the Engine Facility with a variable interest rate of 6.41% at December 31, 2004. See "—GECC Term

Loan Financing" above.

(3)

Includes $90.7 million principal amount of 7.5% convertible senior notes, due 2009, and $21.6 million of interest paid in kind of issuance through

December 31, 2004. For financial reporting purposes, we initially recorded the convertible senior notes at their fair market value on the date of issuance. As

of December 31, 2004, the accreted balance of the convertible senior notes in the accompanying consolidated balance sheet is approximately $68.5 million.

(4)

Includes $252.7 million principal amount of 7.25% senior exchangeable notes due July 2023 with cash interest payable through July 2008 at a rate of 2.49%

on the principal amount at maturity. Thereafter, the notes will cease bearing cash interest and begin accruing original issue discount at a rate of 7.25% until

maturity. The aggregate amount due at maturity, including accrued original issue discount from July 31, 2008, will be $252.7 million.

(5)

Government guaranteed loan includes $343.2 million with a variable interest rate of 2.38% at December 31, 2004 and ratable principal payments due 2005

through 2008. Guarantee fees of approximately 8.0% of the outstanding guaranteed principal balance in 2005 through 2008 are payable to the U.S. Treasury

Department and other loan participants.

(6)

Includes Arizona State loan of $0.8 million due December 2007 with a variable interest rate of 5.97% at December 31, 2004.

35